Technology

Sponsor's article > Updated SunGard Basel II CD now available

SunGard Trading and Risk Systems has updated its Basel II CD to reflect events up to and including October.

Caruana: 2006 implementation of Basel II still on target, despite difficulties

Despite recent controversies in the wake of the third Basel II consultative paper (CP3), Jaime Caruana, governor of the Bank of Spain and chairman of the Basel Committee on Banking Supervision, says he believes the new Basel II Accord will be implemented…

Banks should standardise CDS indexes, says credit derivatives panel

Investment banks should be pushing for standardisation in credit default swaps (CDS) indexes, agreed a panel of credit derivatives experts at Risk ’s Credit Risk Summit Europe 2003 in London.

Sumitomo Corporation installs FNX’s Sierra

Japan’s Sumitomo Corporation has installed FNX’s Sierra System to support its strategy of complete straight-through processing (STP) for its commodities, exchange-traded products and swap-trading operations.

Credit derivatives set to hit $10 trillion by 2007, says Deutsche’s Misra

The credit derivatives market is set to hit $10 trillion in notional value within five years, with the number of actively traded credit default swaps set to double by 2007 to 600, according to Deutsche Bank’s global head of integrated credit trading…

Refco signs up as non-bank member to JP Morgan Chase’s CLS service

Refco Capital Markets has selected JP Morgan Chase as its provider of continuous-linked settlement (CLS) services.

SunGard to offer integrated energy risk system

SunGard Energy Systems, an operating group of Pennsylvania-based SunGard, plans to offer a single integrated suite of energy risk and trading systems called Entegrate.

Deutsche adds e-options

Deutsche Bank will go live with foreign exchange options on its autobahnFX trading platform in January, in response to client demand, a bank official told RiskNews ' sister publication FX Week .

Algo to release flagship Basel II-compliant system in January

Canadian risk management systems vendor Algorithmics will release version 4.4 of its Algo Suite flagship product on January 15.

Sponsor's article > Statistical process control

Too often, finance professionals manifest a smug sense of superiority towards their peers in manufacturing. In this third column in a series, David Rowe argues that when it comes to operational risk management, the manufacturing sector has much to teach…

Black Thursday

The costs of the recent power outage in large parts of northeast USA and Canada range from $6 billion to $10 billion. Hardeep Dhillon looks at the consequences of the blackout and analyzes the impact on the utility and insurance industries.

Algo to release flagship Basel II-compliant system in January

Canadian risk management systems vendor Algorithmics will release version 4.4 of its Algo Suite flagship product on January 15. Its enterprise-wide risk management system will include all the features necessary for Basel II regulatory capital reporting,…

Fame extends data coverage of North American gas and power markets

Data technology software provider Fame has added IntercontinentalExchange (Ice) North American gas and power indexes to its software products.

Luminary Capital Management goes live with FNX risk system

New York-based Luminary Capital Management, a global macro hedge fund, has gone live with technology provider FNX’s Sierra trade management system.

Corporate Statement > Alliance & Leicester Choose WhiteLight

After an extensive review of vendor solutions, Alliance & Leicester, one of the UK's major financial services groups, has chosen WhiteLight, a SymphonyRPM company, to provide their Basel II Retail Credit Risk solution.

CLS impact 'neutral' for RTGS systems

The introduction of the continuous-linked settlement service (CLS) for foreign exchange has had little effect on flows and liquidity on real-time gross settlement systems (RTGS), according to the latest Bank of England (BoE) quarterly bulletin.

National grid information exchange likely

A web-based information exchange on national grid networks is likely to be approved in the next few days, sources told RiskNews ’ sister publication Energy & Power Risk Management at the World Forum on Energy Regulation conference in Rome today. The…

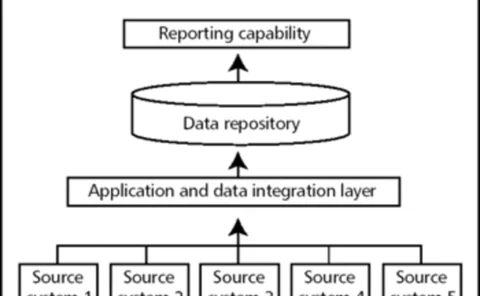

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals

Credit in context

Systems

King ofjunk

Michael Milken

DrKW broadens its horizons

Tech news