Municipal bonds

Clearing members sour further on cash for IM collateral

Sovereign bonds remain preferred choice at top CCPs in Q3

First Republic taps Fed facilities in effort to plug funding hole

Discount window and BTFP provide temporary relief as deposits slump $72bn in Q1

Gensler calls for enhanced US bond market transparency

SEC chief advocates shorter Trace reporting delay, public dissemination of Treasuries trades

Don’t apply OTC equity rules to bonds, says SEC’s Peirce

Republican commissioner warns proposed transparency rule could deter electronic trading of bonds

Insurers’ favourite credit rating becomes more expensive

US institutions face a dilemma: go up a rating and lose yield or go down a rating and increase risk

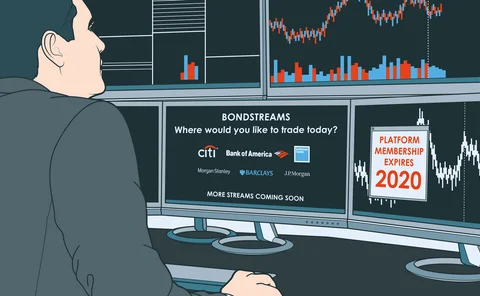

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

State Street bolsters liquidity buffers

HQLA share of investment portfolio grows from 61% to 70% in the first quarter

CVA, fraud and settlement risk

April 28–May 4, 2017

Law firm of the year: Cadwalader, Wickersham & Taft

US law firm proposed relief to Tob programme, and won mandate to develop rule change

Fed rejects muni bonds from US LCR

Tarullo hints at future inclusion subject to criteria

US muni treasurers warn LCR could crimp spending

If US regulators do not count muni debt as highly liquid, issuers fear financing cost rise

Hedge funds tread carefully around Detroit bankruptcy

Unsettling bankruptcy opportunities

Detroit swaps spark fight between dealers and insurers

Detroit spinners

Detroit prepares for court hearing on swaps termination

Court will rule on compromise agreement between bankrupt city and swaps counterparties

JP Morgan Securities charged with rigging municipal bonds

JPMS rigged at least 93 municipal bond reinvestment transactions in 31 states, SEC says

US public pension deficits driving muni yields

Untied states