Energy Risk

Making the grade

As credit risk is now a major concern in the energy industry, EPRM takes a look at CreditGrades, a risk measurement tool from risk analytics firm RiskMetrics

Blurring the lines

A turf war between Atlanta’s IntercontinentalExchange and the New York Mercantile Exchange reveals a shift in the traditional role of over-the-counter brokers and exchanges, finds Catherine Lacoursière

Getting stressed

To understand how much value can be lost from a position in the energy markets, we need to use measures other than value-at-risk. Brett Humphreys discusses methods for creating effective stress tests

A new look at credit risk capital

In the second of two articles on Standard & Poor’s refinement of analytical methodology, John Kennedy discusses an updated approach to evaluating credit risk capital

Struggling for integration

Political issues are stalling Mexico’s energy sector reform just as the country is poised to become a major natural gas importer, reports Maria Kielmas

Between Kyoto and the caribou

Ratification of the Kyoto Protocol on climate change is unlikely to have an effect on the burgeoning Canadian oil and gas sector, as Maria Kielmas discovers

The front-month proxy hedge

The front-month proxy hedge is a correlation-based hedge that seeks to neutralise the aggregate sensitivity of a portfolio to a futures curve by converting the individual futures hedges into a single hedge with respect to only the front-month contract…

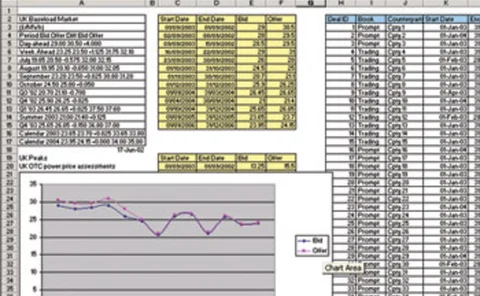

Cell mates

Traders love spreadsheets. But complex deals can quickly outgrow a sheet developed on the fly. Since traders won’t abandon their favourite tools, Stuart Cook and Tony Hughes of The Structure Group look at how firms can control their use

Standardising electricity contracts

Electricity contracts have come and gone, but a new trio of financially settled futures contracts aims to widen the electricity market, reports James Ockenden

In search of transparency

The open secret of index price manipulation in the natural gas sector is officially out, and the industry is scrambling to reform the system. Kevin Foster reports

Rising fuel costs, diving profits

Airlines differ on how to manage jet fuel price ‘hyper-volatility’ as option prices point to more turbulence ahead. Catherine Lacoursière reports

Hedging on a jet plane

The past eighteen months has been a critical time for airlines. FAME Information Services looks at how an airline can reduce operating costs by jet fuel hedging