Basel Committee

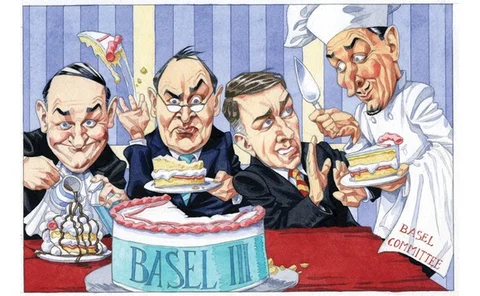

Basel III takes a bite out of aircraft and shipping finance

On the scrapheap

Different preferences create divided implementation of Basel III

A matter of taste

Isda 27th Annual General Meeting Chicago 2012

End in sight?

Bail-in regimes will reduce demand for bank debt - Risk.net poll

Over three-quarters of poll respondents believe new resolution plans will hurt market for bank bonds - at a time when issuance needs to increase

Regulator Q&A: Grant Spencer, deputy governor, Reserve Bank of New Zealand

Despite New Zealand’s domestic banking sector escaping the worst ravages of the recent financial crisis, the Reserve Bank of New Zealand is not wasting any time in introducing the Basel III framework – but with a local twist

BoE's Tucker: FPC capital powers 'won't be popular'

Attendees at ACT conference raise concerns about increased lending costs after Bank of England’s Tucker argues for powers to raise sectoral capital levels

Use of PIT model neutralises impact of counter-cyclical capital buffer

Banks using a PIT model instead of a TTC model may receive a capital saving for the Basel III counter-cyclical capital buffer but such an approach might not be viewed as within the spirit of the rules by regulators

Regulatory differences could be behind RWA inconsistency, report suggests

Initial findings of a review led by the European Banking Federation suggests differences in regulatory regimes could be behind a divergence in RWA numbers

Bank capital

In depth: bank capital introduction

Credible capital: regulators prepare to tackle RWA divergence

Credible capital

Basel 2.5 caused €200 billion jump in RWAs

European banks saw their RWAs leap at the turn of the year, as new trading book rules collided with the EBA's call to achieve a 9% capital minimum

New Zealand proposes partial earlier adoption of Basel III capital requirements

New Zealand regulators have opted to bring in the capital conservation and counter-cyclical buffers ahead of the Basel Committee schedule – but market participants are unsure if this is necessary

Risk Annual Summit: Bank deleveraging 'might not be cyclical'

Aircraft, shipping and project finance all set to lose out as banks seek to constrain capital consumption, panellists warn

Risk Annual Summit: CVA rethink needed, says HSBC risk specialist

Market risk hedges should be recognised when calculating CVA capital charge, says HSBC market risk modelling head

Risk Annual Summit: Loan and bond markets will suffer under Basel III, say panellists

Supervisors should embrace new form of securitisation to encourage bank lending, argues Ernst & Young’s Patricia Jackson

Risk Annual Summit: Deutsche credit risk head questions CRD IV timeline

Banks have nine months until elements of Basel III are due to come into force, but details of implementing legislation are still being debated

Banks tout break clauses as capital mitigant

Breaking with tradition

Beyond Basel 2.5: regulators prepare trading book review

Beyond Basel 2.5

Goodbye VAR? Basel to consider other risk metrics

Trading book review will look at replacing value-at-risk, but quants say the obvious alternative - expected shortfall - is not much better

Let’s hear it for the tail risks

We must recognise the value of the right-hand side of the loss data distribution

Expected problems

The capital reductions to be gained from properly assessing expected losses can’t be ignored, says Marcelo Cruz

Ambition of Basel's trading book review has faded, sources say

Patchwork of risk measures - including standalone CVA charge - may be left intact