Doubts cast on Europe’s IFRS 9 transition period

Dynamic transition viewed as too complicated for banks to use or investors to understand

Doubts have been raised over the usefulness of a transition period designed to mitigate the day one capital impact of new accounting rules, owing to the complexity of the European Union’s chosen approach.

International Financial Reporting Standard 9 (IFRS 9), which comes into force for European banks in January 2018, will upend current accounting convention by forcing banks to recognise expected losses on loans when the likelihood of the borrower defaulting increases materially. This is expected to increase provisions significantly, especially for smaller banks.

The likely knock-on effects on bank capital, with dealers forced to divert retained earnings to increase loss provisioning, has prompted the EU to offer a five-year transitional arrangement, but banks have criticised its approach as too complex to be of use.

“Personally, I would prefer to have no transition. The reason is that the impact studies are showing the one-off impact is not going to be that big, so therefore I don’t think there is any institution that is going to struggle with a one-off application of IFRS 9,” said Adrian Docherty, head of financial institutions advisory at BNP Paribas, speaking at the Banking Book Summit in London on November 28.

“If it reduces the impact, then great, but the cost of that is complexity. Europe has decided to allow a multitude of approaches and to allow the dynamic approach, which is very difficult to understand,” he added.

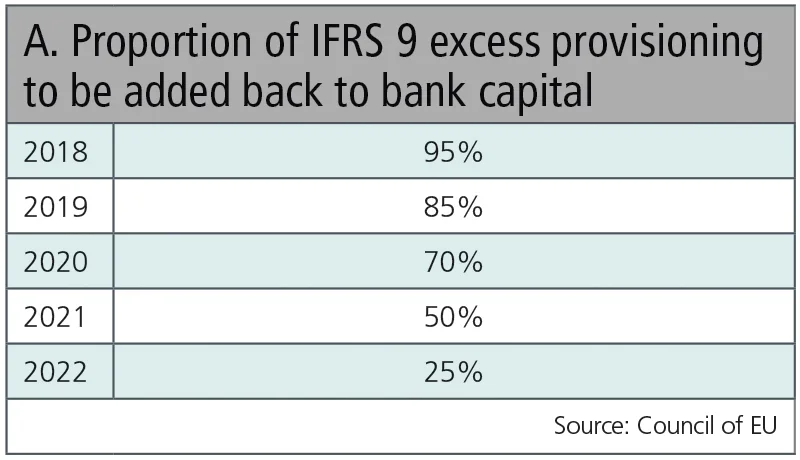

On 15 November, the Council of the EU endorsed an agreement with the European Parliament for a five-year transition period, which will allow banks to add their expected credit loss provisions resulting from IFRS 9 back to their capital in a decreasing amount over five years (see table A).

This is designed to offset the impact of extra provisioning on capital, particularly for banks using the standardised approach to calculate credit risk-weighted assets, rather than using forward-looking loan-loss models.

We have seen with Basel transitioning that the market, faced with all of this complexity and lack of harmonisation, just says ‘give me fully loaded’

Adrian Docherty, BNP Paribas

The final transition package allows banks to choose between static or dynamic approaches – that is, to calculate the capital offset once at the start of the transition period or to update it each year. The European Banking Authority had earlier advised against the dynamic approach, which is much more complicated to calculate – for banks and their investors.

“We have seen with Basel transitioning that the market, faced with all of this complexity and lack of harmonisation, just says ‘give me fully loaded’. With the phase-in, I know the provisioning is coming, so it may as well be shown in today’s numbers anyway,” said Docherty.

Speaking on the same panel, Ingrid Nemetz, an IFRS 9 specialist at the Austrian Financial Market Authority, acknowledged Docherty’s concerns.

“It is a difficult compromise solution. There were many views contradicting each other, and what we are now getting in the end is a very complex transitional arrangement. In this way, it has quite some similarity with IFRS 9 itself, which had a simple goal, and there were so many views and [so much] lobbying that it is rather complicated. Personally, I would have preferred, if we had a transitional arrangement, to have a simple one that is easy to understand, which would have been a static one,” said Nemetz, who emphasised she was speaking in a personal capacity.

“But, on the other hand, there was reasoning, which was the fear of volatility and the dynamic nature of IFRS 9 itself, so now we have this dynamic component of the transition period. I think it is hard to understand and even harder to implement technically, because there are so many consequential calculations you have to do for exposure values and for deferred tax assets. If you want to do that, it is quite an effort, and I’m not sure if banks are going to use it,” she added.

Nemetz also agreed with Docherty that investors are likely to look through the transitional number to the final IFRS 9 reported balance sheet.

Waiting for Basel

However, Docherty emphasised the transition period could be useful if it gave time for the Basel Committee to agree changes to credit risk capital rules that would allow all banks to add back to capital any accounting provisions beyond the regulatory expected 12-month losses. This is essential for banks on the standardised approach to credit risk, which must otherwise double-count the cost of the additional IFRS 9 provisions in their capital ratios.

“If it’s the wrong destination, then any transition is the wrong thing to do… But any solace, any mitigant, any reduction or neutralisation of IFRS 9 is welcome,” said Docherty.

He said the European Banking Federation was already in contact with the Basel Committee, which understood the situation, but he warned the market needed clarity quickly.

“That process is happening, but I don’t think the Basel process is going to adapt to IFRS 9 very quickly. The transition helps, but we have to make sure the market realises there is going to be some sort of ‘compatible-isation’ of the capital with the provisions framework, and try to keep it together until Basel can do something. But, as we have seen with Basel IV, the Basel process is quite difficult when working internationally,” said Docherty.

In its half-yearly Financial Stability Report, also published on November 28, the Bank of England made clear the need for the capital impact of IFRS 9 to be neutralised: “The Financial Policy Committee will take steps to ensure the interaction of IFRS 9 accounting with its annual stress test does not result in a de facto increase in capital requirements.”

Nemetz also expressed pessimism regarding how fast the Basel Committee could proceed with adapting the credit risk capital framework for IFRS 9.

“It is good to have simple solutions and equal methods, but that is hard to reach – there are different goals from the prudential point of view and the accounting point of view, [which is] the true and fair view. I am not sure if that is going to be reached in the mid- or long-term. We didn’t even reach common accounting standards with US GAAP,” said Nemetz.

Following six years of negotiation, a project to converge IFRS with the US Generally Accepted Accounting Principles failed in February 2014.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Esma supervision proposals ensnare Bloomberg and Tradeweb

Derivatives and bonds venues would become subject to centralised supervision

Industry frowns on FCA’s single-sided trade reporting efforts

Buy side warns UK attempt to ease Mifir burden may miss target; dealers aren’t happy either

One vision, two paths: UK reporting revamp diverges from EU

FCA and Esma could learn from each other on how to cut industry compliance costs

Market doesn’t share FSB concerns over basis trade

Industry warns tougher haircut regulation could restrict market capacity as debt issuance rises

FCMs warn of regulatory gaps in crypto clearing

CFTC request for comment uncovers concerns over customer protection and unchecked advertising

UK clearing houses face tougher capital regime than EU peers

Ice resists BoE plan to move second skin in the game higher up capital stack, but members approve

ECB seeks capital clarity on Spire repacks

Dealers split between counterparty credit risk and market risk frameworks for repack RWAs

FSB chief defends global non-bank regulation drive

Schindler slams ‘misconception’ that regulators intend to impose standardised bank-like rules