Austria

Russian loan liquidation lifts RBI’s risk density

Cash parked at sanctioned central bank carries higher capital requirements than original loans

Decoding the decoupling in US and eurozone inflation

ECB rates cut and Fed’s refusal to follow suit point to differing fundamentals in stateside and EU economies

At BayernLB, Nykredit and Erste, op risk charges hit multi-year highs

Annual model recalibrations responsible for double-digit rises

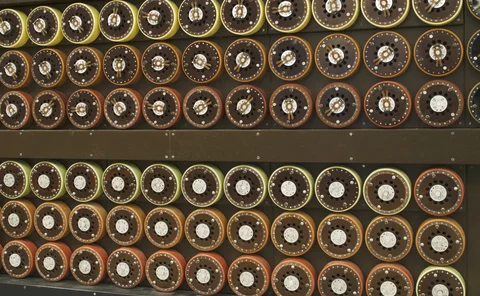

RBI’s op risk charges climb 22% on input-series update

Recalibration reverses savings from discontinuation of AMA a year earlier

RBI’s modelled market charges surge 31% as SVAR spike

Widespread volatility in first half of year inflated stressed gauge despite 2022 wind-down of rouble positions

Santander, Credit Suisse hit hardest by AOCI in Europe

Unrealised losses, mostly from exchange rate swings, shave huge chunks off CET1 capital

RBI reverts to standardised op risk modelling

Austrian bank hopes switch away from AMA to temper requirements’ sensitivity to legal provisions

RBI’s VAR gauges hit new record

Banking and trading book risk rose in Q3 amid shifts in risk factor mix

Erste, RBI top up provisions with €258m in overlays

Austrian lenders remain reliant on model supplements as energy squeeze looms

RBI, ING’s op risk charges inflated by AMA updates

RWAs rise a combined €4.8 billion at the two banks

Some euro banks modelled lower mortgage risk in H1

Italian and Belgian lenders reported steepest drops in risk density despite recessionary threat

Raiffeisen to rejoin Euribor panel, reversing exodus

Austrian bank’s return as benchmark contributor could be “turning point” for interbank rate, says administrator

EU banks add overlays as crises evade modelling

Lenders buttress provisions against unpredictable fallout from Russia's invasion of Ukraine

Erste sees provisions rising fourfold in gas embargo scenario

Vienna-based bank wargamed for an unlikely but devastating halt to Russian gas shipments

RBI’s CET1 ratio rebounds after briefly breaching requirements

The Austrian bank said capital adequacy temporarily fell below the regulatory minimum in May

Polish mortgage claims push RBI’s op risk up 43%

Following the latest increase, op risk makes up 11% of the bank’s total RWAs

RBI’s market risk gauges go haywire on Ukraine war fallout

Portfolio reshuffling helps Austrian bank contain RWA impact

EU banks kept building Russian exposures as sanctions loomed

Latest EBA data shows the bloc’s lenders cut holdings of government debt securities, but increased commitments to private sector

Raiffeisen’s Russia assets hit new high at end-2021

The Austrian lender kept growing its balance sheet in the country even as Moscow’s manoeuvres put it on a path to all-sweeping sanctions

SRB faces tough choices over Sberbank Europe failure

Both resolution or liquidation could lead to losses for public purse, depending on client base

Russia sanctions risk putting $105bn out of foreign banks’ reach

But international claims on the country have fallen by half since 2014