Market liquidity has been drained by regulations, says DBS chief

Volcker, Basel III and Dodd-Frank have combined to drain liquidity – particularly in times of market stress

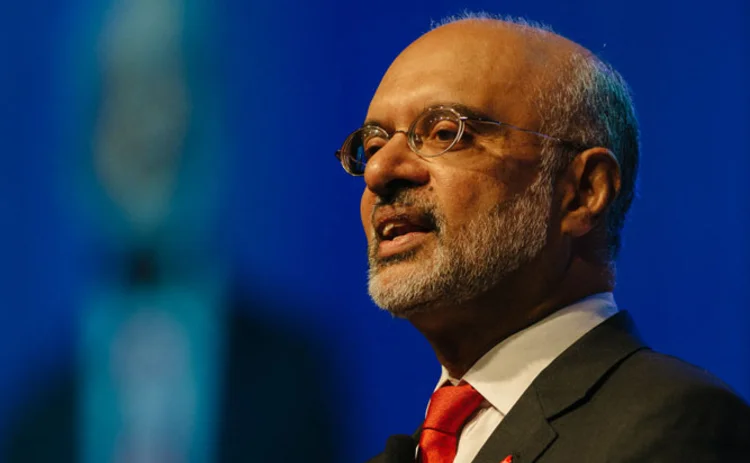

A host of new regulatory requirements governing financial institutions' trading activities has significantly restricted banks' capacity to absorb risk and provide liquidity, according to Piyush Gupta, chief executive officer at Singaporean lender, DBS.

Speaking at the 11th Asia Risk Congress on September 9 in Singapore, Gupta pointed to Basel III capital requirements, Dodd-Frank and the Volker rule as all combining to negatively impact market liquidity.

"It is quite clear that the new capital

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Dora flood pitches banks against vendors

Firms ask vendors for late addendums sometimes unrelated to resiliency, requiring renegotiation

Swiss report fingers Finma on Credit Suisse capital ratio

Parliament says bank would have breached minimum requirements in 2022 without regulatory filter

‘It’s not EU’: Do government bond spreads spell eurozone break-up?

Divergence between EGB yields is in the EU’s make-up; only a shared risk architecture can reunite them

CFTC weighs third-party risk rules for CCPs

Clearing houses could be required to formally identify and monitor critical vendors

Why there is no fence in effective regulatory relationships

A chief risk officer and former bank supervisor says regulators and regulated are on the same side

Snap! Derivatives reports decouple after Emir Refit shake-up

Counterparties find new rules have led to worse data quality, threatening regulators’ oversight of systemic risk

Critics warn against softening risk transfer rules for insurers

Proposal to cut capital for unfunded protection of loan books would create systemic risk, investors say

Barr defends easing of Basel III endgame proposal

Fed’s top regulator says he will stay and finish the package, is comfortable with capital impact