United States

US dollar Libor’s fate in doubt after IBA delays funeral plans

Decision to exclude US dollar Libor from cessation plan is being treated as effective extension

UBS gears up for another tilt at clearing

Swiss bank makes senior hires and upgrades tech platform ahead of Brexit and leverage offset

CFTC’s Behnam: regulators must be alert to ‘greenwashing’

Risk USA: ESG products that miss sustainability goals may fall foul of customer protection rules

Liquidity buffers thinned at Morgan Stanley, Goldman in Q3

Build-up of HQLA slows over the third quarter after post-Covid surge

EU’s dividend ban overshadows reform effort

Banks may be reluctant to run down buffers even if regulators soften the MDA threshold for payouts

JP Morgan had most profit-making trading days of top banks in Q3

New York-based bank posted 45 winning trading days in total

Quarles’ legacy Libor contracts plan stirs confusion

Cryptic comment feeds speculation about synthetic US dollar Libor – prompting pushback from ARRC

PNC to be king of US regional banks after BBVA tie-up

Merger unlikely to tip PNC into too-big-to-fail category

BofA the outlier as most US banks improve SLRs in Q3

Aggregate Tier 1 capital climbs 2% in Q3

NY Fed’s Stiroh: ‘cultural capital’ at risk in pandemic

Risk USA: remote working could “erode” the culture of financial firms, says senior regulator

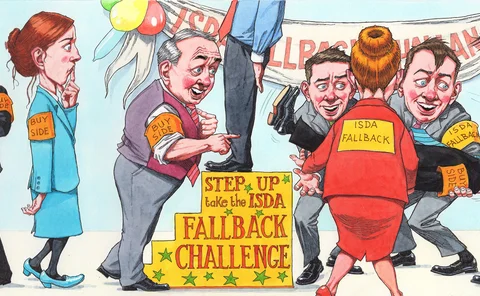

The buy side and Libor: it’s decision time

Investors weigh pros and cons of signing newly released Isda fallback protocol, as Libor demise looms

To offset US sanctions risk, banks bake in China loan clauses

Global lenders seek to hedge against the threat of US sanctions on China – which seems unlikely to ease under Biden

Citi’s counterparty credit risk edged higher in Q3

Risk-weighted assets for OTC derivatives, repo, margin loans jump 11%

US systemic banks’ op risk charges fell in Q3

Bank of America’s charge falls 26% following a model change

Bloomberg joins race for SOFR credit add-on

Benchmark provider building bolt-on adjustment from short-term bank lending data

SOFR trading tails off after ‘big bang’ boost

Volumes peak, then slow down on CCPs’ shift to new RFR, but remain above 2020 averages

G-Sibs see little sign of relief on Fed’s systemic buffer

Central bank liquidity and Treasuries will push US firms into higher G-Sib buckets

Top US-based foreign banks shrink systemic footprints

US units of Barclays, Credit Suisse and Deutsche Bank have cut assets 40% since Q3 2016

Congress readies surprise ‘tough legacy’ Libor fix

Federal legislation to ensure legacy Libor contracts can move to SOFR is in the works

Op risk data: Firm-wide control fails cost Citi $400m

Also: Deutsche draws fire and AML fine over Danske trades. Data by ORX News

Joe Biden’s slow road to remaking US financial regulation

Moves on climate risk could come early; other changes may have to wait until end of 2021, or later

Why the US election fallout was not a surprise to banks

A contested result was unexpected, but scenario planning meant banks weren’t unprepared

Ice tees up CDS options launch for November 9

Fight for CDS market share heats up as Ice begins clearing options and LCH preps CDX offering

Basis trades: a test case for regulating risky activities

FSOC is right to focus on dangerous behaviour, but Treasury meltdown reveals a complex chain of actors