United States

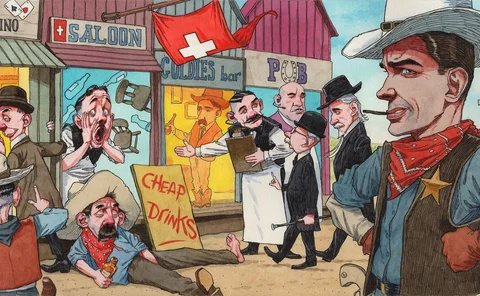

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Yen swaps users stuck in clearing Catch-22

Lack of access to client clearing at JSCC poses problems for US buyers of Japanese government bonds

Who wants to buy US Treasuries?

Federal Reserve’s journey to tapering will be paved with volatility and weaker demand

Citi turns to decrement indexes for single-stock autocalls

US bank claims new Stoxx indexes for 23 single names will slash hedging costs and boost coupons

Net losers? Benefits of clearing US Treasuries are cloudy

Practical obstacles and questionable netting benefits muddy the path to a clearing mandate, argues economist

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Corporates remain on swaps fallback sidelines

Risk.net analysis finds just 14 out of 100 large non-financial firms have signed up to Isda fallback protocol

ARRC’s Wipf ‘puzzled’ by appeal of Libor-like benchmarks

Credit-sensitive benchmarks face questions over inputs and compliance

Trading VAR at UBS peaked after Archegos blow-up

Swiss bank still posted a fall in market RWAs quarter on quarter

Simm template to be expanded for SA-CCR and FRTB

Crif-plus will capture risk exposures for all instruments, boosting optimisation potential

Basel playing catch-up on climate risk, say experts

Individual regulators have already gone further in encouraging transition

CME unveils term SOFR in face of ARRC doubts

Exchange group says benchmark aligns with ARRC principles – but committee has pushed back endorsement plans

Botched fallbacks leave CLOs facing early Libor switch

Nearly two-thirds of CRE securitisations issued since 2019 have already triggered fallback clauses

After Archegos, Credit Suisse clients tap rivals for clearing

Swiss bank is said to have lost clearing business amid uncertainty over its future

Euro swaps clearing showdown pits banks against Brussels

Forcing swaps clearing to Frankfurt would play into hands of US rivals, say European dealers

Systemic US banks released $9.4bn of credit reserves in Q1

JP Morgan reversed $4.2 billion of provisions alone

Morgan Stanley’s VAR hit eight-year high in Q1

High risk-of-loss indicator coincides with Archegos collapse

BofA kept up bond binge in Q1

Bank added $172bn of debt securities to portfolio over first three months of the year

FCA could get legal with USD Libor laggards

Incoming powers permit regulator to ban use of benchmarks with known cessation dates – but only for UK-supervised firms

JP Morgan’s SLR falls as Fed relief ends

Bank says raising capital against deposits are “unnatural actions for banks”

US federal legislation ‘eliminates’ need for synthetic Libor

‘Tough legacy’ proposal will be discussed at a House Financial Services subcommittee meeting on April 15

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps

One FICC member paid record $102bn to cover dues in Q4

Previous highest payment obligation of a single participant was $77 billion in size

Initial margin at Ice CCPs surged over 2020

Required IM at Ice Clear US increased 42% year on year