United States

Top US banks record 14 VAR breaches

JPM, Morgan Stanley, BofA, Citi, Goldman and State Street wrong-footed in volatile end to 2021

Shadow US banks cool on riskier leveraged loans

Lowest-quality syndicated loans held by non-banks fall, though they remain well above pre-pandemic levels

GM Financial’s derivatives fall 72% in value in 2021

A steeper forward interest rate curve paired with an appreciating dollar erased most of the gains booked by the carmaker’s lending arm in 2020

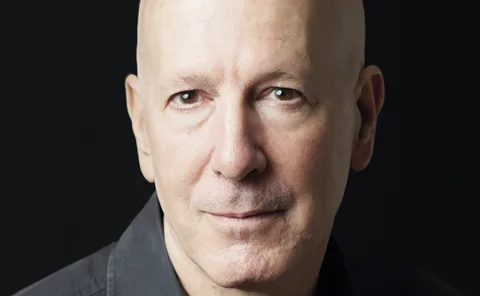

Bookstaber: past performance is no guide to future risks

Veteran risk chief says trading gains in wake of LTCM’s demise forged love of agent-based modelling

Fillip for credit-sensitive rates as Axi, Critr advance

IHS Markit makes benchmarks available for live products; Invesco appointed as Axi administrator

Clearing house of the year: OCC

Risk Awards 2022: Risk management reforms help clearing house weather meme stock volatility

Risk Awards 2022: the winners

JP Morgan claims top derivatives house, lifetime award for Mark Carney, BofA wins rates

SEC outdoes Europe on hedge fund, private equity disclosures

US to ban preferential treatment and introduce quarterly performance updates in rule shake-up

Equity markets have become so complex as to defy explanation

Experts struggle to rationalise wild swings in a market that is almost unrecognisable

EU banks fear outlier status on non-modellable risk charges

Dealers face disadvantage if EU implements more granular and costly version of FRTB than US, UK

The Collins flaw: backstop turned binding constraint

US legislative tweak was meant to prevent banks from using their own capital models too liberally. It’s now something different

Op risk data: Morgan Stanley, Capital One’s data breach double trouble

Also: Citi shells out $45m for misleading stock trading info; coding clangers cost Credit Suisse $9m. Data by ORX News

Product innovations push deal contingents beyond M&A

Banks entice new users with hedges related to IPOs and bankruptcy procedures

Banks rely on clients to police US Libor ban

Dealers say it’s “impossible” to verify end-user compliance with narrow Libor exceptions trade by trade

People moves: new Credit Suisse chair, and more

Latest job changes across the industry

Banks offer crypto clearing but, shhh, don’t tell

Top dealers clear crypto futures for select clients despite smorgasbord of risks

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Shell-company registry might not halt US dirty money, say experts

Observers raise questions over verifying beneficial owner info on proposed FinCEN database

CFTC delays rewritten swaps reporting rules after industry plea

Firms still face multiple rounds of compliance to implement UPI and ISO standards

CCPs to review conversion blueprint ahead of SOFR switch

Rising rates vol expected to push US transition to the wire, but process likely to follow previous runs

US funds piled on index hedges ahead of stock selloff

Counterparty Radar: Filings show managers adding more than $5.5 billion of puts in Q3, setting new high

Foreign banks flocked to Treasuries and Fed in Q3

Claims rose at fastest annual pace since early pandemic amid inflation jitters

Autocalls in peril as Netflix breaches downside barriers

Options liquidity keeps hedging panic at bay as some investors double down on volatile tech stocks

All top US banks below Collins floor

None of the eight systemic banks in the country above the threshold for the first time since 2015