Norway

Final Fatca regulations fail to include draft FFI agreement

Hotly anticipated final Fatca regulations leave industry disappointed and without an agreement for non-IGA FFIs

Q&A: Christian Clausen on bank capital, systemic risk buffers and bail-in debt

Hitting the buffers

Nordic banks push for Fatca deal

Nordic banking associations open Fatca reciprocity talks

More sovereigns edge towards two-way CSAs - and clearing

Towards two-way CSAs

Eksportfinans faces collateral questions following downgrade

Junk-rated export lender says it has enough reserve liquidity to meet obligations while it is being wound up - but dealers are not convinced

Foreign regulators leave US isolated on uncleared margin rules

Follow the leader?

Regulation not key driver for ERM within Nordics

ERM is being driven from within firms in the Nordic countries, according to survey results

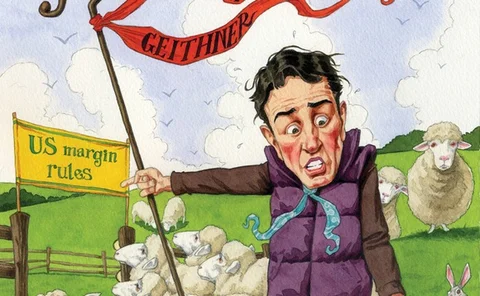

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

EBA stress test results shed light on sovereign derivatives exposures

European bank sovereign derivatives exposures revealed

Statoil stung by hedging derivatives losses

Norwegian oil and gas giant Statoil's results are hit by major losses on hedging derivatives in spite of a rise in profits and production

Nordic markets warm to central clearing

Regulators across the globe are intent on forcing over-the-counter derivatives through central clearing. How are supervisors in the Nordic region responding, and could the relative lack of liquidity in domestic markets hamper their efforts? By…

Solvency II to increase FX hedging

Solvency II could cause rise in foreign exchange hedging programmes by insurers

DnB Nor returns to the Norwegian structured products market

Nordic bank DnB Nor will resume distribution of structured products to high-net-worth investors and affluent retail clients in Norway on May 25. The two new products, translated roughly as “Global ‘Trigg’ (safe)” and “Top Norden” (top selected stocks…

Binge then bust

Politicians have recently expressed alarm at a cross-currency swap conducted between Greece and Goldman Sachs in 2001, which allowed the sovereign to reduce the debt it reported in its public accounts. But other examples now coming to light show the…

Lukoil-led consortium seals Iraq deal

A consortium led by Russian private oil company Lukoil is the latest in a line of energy giants sealing deals in Iraq, in a move set to develop one of the country’s largest oil fields.

Nordic horizons

Markets in the Nordic region have been far from immune from the troubles that have hit structured products across Europe. But speakers and delegates at the Structured Products Nordic Region conference spoke of light on the horizon - despite the pressing…