London

Quant grad conveyor belt stalls as banks retrench

Jobs market is long quant graduates, short vacancies – but hiring freeze shows signs of thawing

The Giancarlo spirit: wobbling but not falling

The burden of US extraterritoriality rules may be easing

Cherry-picking fears as banks pull negative rates commitments

As UK mulls negative rates, banks desert Isda protocol and traders warn of gaming the system

To offset US sanctions risk, banks bake in China loan clauses

Global lenders seek to hedge against the threat of US sanctions on China – which seems unlikely to ease under Biden

Ronin, felled prop giant, shuts up shop

Firm cancels regulatory licences; traders receiving payouts on equity stakes

Eurex passes volatility test with flying colours

Eurex explores how Covid‑19 volatility across the industry has tested market participants’ resilience, and how the central counterparty itself has proved its credentials as a reliable and sustainable euro liquidity pool

Why investors are stuck with flawed VAR models

Buy-side risk survey: VAR wasn’t much use in March, but it is ingrained in the industry

LME distressed at severity of Esma stress tests

Watchdog’s simulated price shocks said to be unprecedented in metals markets

Global investing under water? – Climate change could leave equities exposed

As impending global changes brought about by climate change loom, one issue in particular threatens to cause massive losses to institutional investors – rising sea levels. David Lunsford and Boris Prahl, of MSCI, explore where, despite the efforts of…

A sea change – Driving awareness to confront climate risk

Amid a global push towards green policies, the reality of overhauling how industries worth trillions of dollars operate is causing concern. A forum of market participants and sponsors of this report discuss the levels of awareness of climate risk and its…

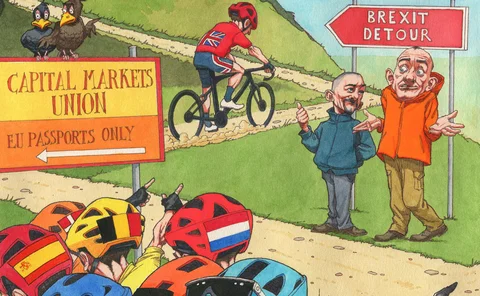

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Treasurers turn to AI in bid for sharper forecasting

Wider automation could usher in future of ‘hands-free hedging’, but obstacles lurk in data standards and sharing

Exploring new investment prospects in volatile markets

Custom and traditional proprietary indexes have been growing in popularity and actively transforming the investment landscape. Financial products linked to indexes are thriving, enabling more efficient access to the market, whether it is equity, bonds or…

FX aggregators flirt with scrutiny over brokerage charges

Making dealers pay for trades raises ‘payment for order flow’ questions

How Onyx came from nowhere to conquer oil swaps

In just four years, market-maker has become the largest provider of liquidity in energy derivatives

Top 10 operational risk losses of 2019

Fraud, embezzlement, tax evasion, subprime (still) and rogue trading – and Citi crops up twice. Data by ORX News

Singapore’s banks eye LCH membership

London CCP’s move to clear for stranded SGX clients pays off, amid broader Apac membership push

Dark materials: how one academic is delving into data

David Hand shines a light on dark data and the dangers of distortion by absence

Stock-picking finds unlikely champion in ex-Winton CIO

Matthew Beddall’s Havelock restyles value investing for the big data age

Prime services – It’s about what you bring

There are many benefits to integration – particularly when it comes to the provision of prime services. Societe Generale has followed this path, which has allowed it to improve cost efficiency and improve the range of products it can offer. The bank has…

Cat risk: why forecasting climate change is a disaster

Forecasters are poles apart on climate-driven catastrophes; insurers fear worse ahead

Politicians must heal a fractured UK society

Political journalist Robert Peston has grave concerns over the future of Britain, seeing profound risks with or without Brexit

Search for alpha in a volatile world

Alpha generation can be an elusive goal, particularly when trading volatility. Three different approaches to trading volatility were discussed by a panel looking at the role of systematic and carry strategies in finding profit in a high-volatility world

ESG investing: It’s not just great to be good

Investing according to environmental, social and governance (ESG) criteria can be done in various ways, with continuing development of filters and ways of analysing companies. As the market in ESG indexes and investments linked to sustainability matures,…