Europe

Lighting up the black box: a must for investors?

Many contend you must be able to interpret machine learning in order to use it

Growing sanctions raise compliance risk for energy firms

Sanctions increase risk for energy firms as regulators step up enforcement, writes maritime data expert

Autocalls hit peak vega, where hedging costs mount

Eurostoxx and Nikkei losses flip structured product dealers into painful short vol territory

iTraxx volumes spike amid market panic

Volumes of Ice-cleared index contracts more than four times higher than average

ECB cuts top banks’ required capital by over €350bn

Capital conservation requirement and Pillar 2 guidance amounts relaxed, countercyclical capital buffers encouraged to fall

Spot FX could be dragged into Mifid II

EC tells Risk.net it is studying Australian-style approach to regulating currency trading

Funds try to predict behaviour of mystery investors

New EU rules on liquidity stress-testing force fund managers to hunt out clues on investors

Of rats and men: would member compensation imperil CCPs?

CCPs and members split over whether compensation after default losses is moral hazard or fair

The open data revolution in banking falls short

Lax Pillar 3 rules are leading to inconsistent data being collected

Oil price shock triggers big margin calls

Banks and exchanges worked through weekend in anticipation of oil collapse

EU banks face near €18bn capital shortfall through output floor

Twenty-one out of 51 banking groups surveyed would be constrained by the output floor

Splits emerge over EBA’s stress test 2.0

Experts question utility of separate bank leg that won’t feed into capital requirements

SOFR drought, CB accounts for CCPs, and the Top 10 Op Risks

The week on Risk.net, February 29–March 6, 2020

Dealers turn to mid-cap and EM deal-contingent trades

Premiums of more than 25% are attractive to banks battling low vol and increasing competition

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

Apac CCPs: we’ve come a long, long way together

Members still gripe about arcane policies, but risk management fundamentals are strong

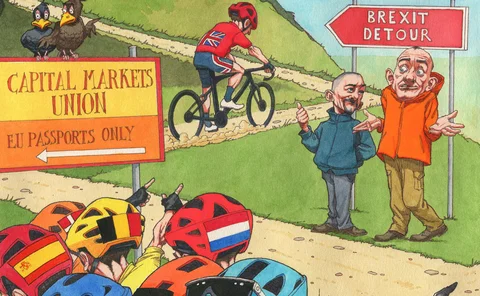

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Top 10 operational risks for 2020

The biggest op risks for 2020, as chosen by industry practitioners

Top 10 op risks 2020: regulatory risk

New technology and reams of red tape make non-compliance fines more likely

Top 10 op risks 2020: geopolitical risk

Nationalism, trade wars and epidemics make for a heady cocktail

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

All aboard for LNG freight derivatives?

Tools to manage LNG freight risk were developed last year, but how is the market responding?

Treasurers turn to AI in bid for sharper forecasting

Wider automation could usher in future of ‘hands-free hedging’, but obstacles lurk in data standards and sharing

CME, Eurex rebuff calls to compensate members for losses

BlackRock and BNP want CCPs that recover from a default to reimburse members and clients