Europe

Iosco delays pre-hedging consultation to November

Review into controversial practice splits industry

Marex plots interest rate clearing push

UK broker is live on LCH and plans to be a “day one” clearing member on FMX

People: SocGen’s Farah replaces Salorio, Deutsche makes credit hire, and more

Latest job changes across the industry

NatWest, StanChart, Nationwide drive record op RWAs at UK banks

BoE data shows operational risk RWAs highest going back to 2014

Investors choose safer bank bonds as AT1 opportunity wanes

Technical factors mean senior bank bonds now offer relative value

Sliced and sliced again: investors’ latest trick for risk transfer

‘Retranched’ synthetic securitisations offer higher yields, but questions remain over legality of structures

HSBC’s stage 3 loans jump in H1 by most since pandemic

Deteriorating CRE loans in Hong Kong drive surge

Eurex default fund reshuffle leaves members frustrated

Clearing members say concentration margin add-ons would be fairer than buffer on all portfolios

HSBC loses FX forwards market share with EU funds

Counterparty Radar: UK bank reported 6% drop in notional volumes with Ucits funds in H2 last year

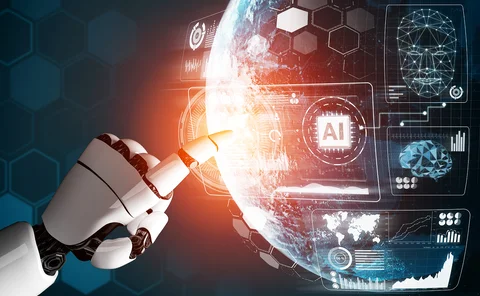

Tired of fat-finger blunders, G-Sibs turn to robots for help

Big banks speed up shift towards control automation and AI adoption to counter costly human errors, Benchmarking survey finds

Corporate ‘greenium’ reveals effect of ESG rules on returns

Analysis of sustainable products shows how SFDR has caused a shift in investor behaviour, writes economist

SocGen’s TLAC ratios drop following senior preferred debt exclusion

Bank’s decision to waive CRR option pushes bail-in funds to lowest since 2020

New fee plans for FXGO rile dealers

Bloomberg plans to charge spot FX market-makers from next year

HSBC’s VAR up by a third amid methodology change

Duration risk behind latest spike as bank switches to 10-day holding period

BNPP transfers €8bn of liabilities to Level 3

Revision in level-setting responsible for biggest net transfer in at least eight years

RBI’s VAR spikes on FX fluctuations

Ruble trouble sends market RWAs up €1.4bn

For compliance risk, the big get bigger

Second-line teams have been growing at US G-Sibs – and are set to continue – while Europeans’ flatline

NatWest securitisation RWAs hit record high in Q2

Higher amounts of significant risk transfers originated by the bank behind latest increase

Athora CFO exit caps management overhaul

Entire management team at Apollo’s European insurance affiliate has been replaced since 2022

Hedge funds pile into euro systematic vol selling

Range-bound rates markets in Europe entice hedge funds to sell short-dated straddle positions

Four EU banks forecast capital hits from final Basel III reforms

BNP Paribas only dealer to disclose hit from FRTB

The boy who cried ‘outlier’: false alarms could dog EBA test

Analysis reveals banks deemed outliers by net income test are profitable post-shock, so how useful is the test?

Insurers deny cyber premiums are rising

Contrary to banks’ complaints, underwriters and brokers claim current market for policies is soft

Stage fright: lenders still struggling with IFRS 9 transitions

Divergence in how banks move loans between stages of impairment prompts regulators to push for more homogenous approach