Europe

Large corporates unconvinced by Emir reporting gift

Corporates ask for opt-out from Emir reporting changes proposed for their benefit

Banks tap equities and FX staff for fixed-income fizz

BAML, HSBC, RBC, StanChart among banks transferring e-trading know-how

Commodities firms fear EBA’s inappropriate capital charges

Energy lobbying overlooked as proposed regime threatens vigorous demands

The price is still wrong: banks tackle bond CSA discounting

Diverging Eonia and European repo rates spur banks to look at valuations of swaps with bond collateral

Isda: EU position limits to snag few OTC commodity contracts

Narrow definition could exclude certain trades and lead to netting problems

Compression is your friend, energy firms told as Mifid II nears

Slashing gross notional of trades can keep firms out of reach of incoming rules

Buy side unimpressed with Mifid II cost transparency rules

Clients question value of receiving dealers’ swaps profit margin data

LCH limits substitution to tackle quarterly collateral flight

CCP clamps down on bond-for-cash switches driven by reporting and quarter-end repo spikes

US dealers wade into European CCP relocation debate

CFTC hearing warns of increased margining costs and a pre-Brexit client onboarding crunch

Focus on Basel output floor calibration misses the point

Until all the final standardised approaches are known, the floor has little meaning

Basel capital floor faces credit risk eclipse

Impact of capital floor depends on new credit risk rules and changes to treatment of provisions

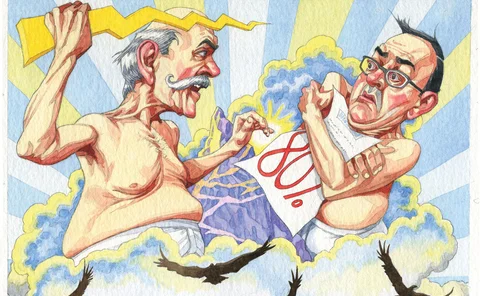

US learns to play the Basel game

Mnuchin report marks a US regulatory shift – from leadership to gamesmanship

Numbers game: Mifid guidance adds to swaps trading confusion

Market participants say using strike price to determine trading obligation will be impossible

Quant Guide 2017: University of Bologna

Bologna, Italy

Quant Guide 2017: Bocconi University

Milan, Italy

Quant Guide 2017: University of Florence

Florence, Italy

Quant Guide 2017: Erasmus University Rotterdam

Rotterdam, Netherlands

Quant Guide 2017: EPFL

Lausanne, Switzerland

Quant Guide 2017: ETH Zurich/University of Zurich

Zurich, Switzerland

Quant Guide 2017: University of York

York, UK

Quant Guide 2017: University of Copenhagen

Copenhagen, Denmark

Quant Guide 2017: University of Warwick

Warwick Business School, Coventry, UK

Quant Guide 2017: Technical University of Munich

Munich, Germany

Quant Guide 2017: University of Oxford

Oxford, UK