Societe Generale

Big EU banks’ Level 3 assets up 25% in 2018

Hard-to-value assets rise €35 billion year-on-year

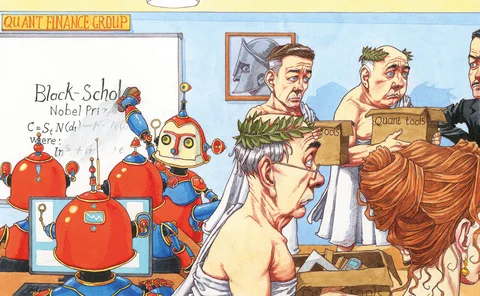

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

Restructure boosts SocGen’s capital and liquidity ratios

CET ratio hits 12%; LCR 134%

Global banks grapple with China joint ventures

Offshore lenders weigh raising stakes in local securities houses despite tight margins

FICC dominates US Treasury repo in Q2

Clearing house’s sponsored programme claimed $449.7 billion of US Treasury-backed trades

Is there safety in numbers for op risk? One regtech thinks so

Acin’s library of op risks allows banks to compare their controls with their peers’

People moves: CRO role for SG’s Ricke, Barclays continues hiring spree, new SwapClear head, and more

Latest job changes across the industry

Eurozone G-Sibs’ op RWAs fall €8.1bn in Q1

Deutsche Bank led the charge with €6.4bn reduction

One size does not fit all – Adapting to meet investment goals

Guillaume Arnaud, global head of quantitative investment strategies (QIS), and Sandrine Ungari, head of cross-asset quantitative research at Societe Generale, explore the benefits of QIS for investors, why flexibility is crucial for investors to meet…

Corporate loan exposures weigh on EU banks

Risk density across EU G-Sibs stood at 93% for corporate loan exposures

SME loans more capital intensive for big eurozone banks

Corporate loans to smaller enterprises attract high risk weightings

Eurozone G-Sibs’ swaps notionals fall €9.6trn in 2018

Deutsche Bank’s portfolio shrinks 16% year-on-year

Level 3 assets at eurozone G-Sibs swell to €82bn in 2018

IFRS 9 likely contributor to first increase in Level 3 inventories since 2014

US banks’ liquidity buffers thinnest among G-Sibs

Mean LCR of US banks hits 122.5% in Q1

Banco Santander’s CVA charge drops 20% in Q1

Three EU G-Sibs cut capital requirements, three increase them

European and UK leverage ratios fall in Q1

UK banks had leverage ratios on average 26bp higher than their continental European peers

People moves: new role for SG CIB’s Cartier, LCH rates head departs, BNP Paribas’s Akbay joins Goldman, and more

Latest job changes across the industry

China Minsheng and SocGen team up for quant index product

CMBC Macro 1 signal index attracts $580 million as investors adapt to products without performance guarantees

Single Resolution Fund fees jump at most large EU banks

Contributions fall for Deutsche Bank and Societe Generale

Energy Risk Awards 2019: The winners

BP and Engie pick up two awards each, while BNPP takes the coveted derivatives house of the year

People moves: Barclays’ investment bank chief exits, Citi president to retire, Vos promoted at BNY Mellon, and more

Latest job changes across the industry

SocGen makes great strides to 12% capital target

Risk-weighted asset movements improve CET1 ratio by 23bp alone

Nordic, UK banks have highest countercyclical buffers

Nordea, Lloyds and RBS had the largest add-ons of banks surveyed