SAS

SAS is a global leader in data and artificial intelligence. With SAS software and industry‑specific solutions, organisations transform data into trusted decisions. SAS gives you The Power to Know®.

For more than 40 years, SAS has delivered consistent value to the insurance industry and its leaders. Worldwide, approximately 1,000 insurers of all sizes rely on SAS to build a better customer experience, help detect and prevent fraud, optimise risk and pricing management, and prepare for tomorrow’s challenges.

Breaking silos: agile insurance in an uncertain world

Insurers are realigning strategy and operations in the face of growing uncertainty and more complex risk

Early warning signals of credit deterioration to save on potential losses

With financial institutions facing market volatility and high interest risks in 2023, the warning signals cannot be overlooked. It is crucial to have access to reliable and timely indicators of credit deterioration to prevent significant losses. This…

Reimagining the insurance industry with technology

Innovation and technological advancement have become key components of how firms stay competitive and efficient in today's insurance industry. Across actuarial, finance, analytics and IT departments, there is pressure on the industry to stay ahead of…

The importance of data-driven decision-making in Apac

Embracing data-driven decision-making enabled by digital technologies is crucial for the success of lending institutions in Apac

Navigating IFRS 9: strategies for effective implementation, and what comes next

A recent webinar focused on the Apac region, sponsored by SAS and Intel, explored the key challenges of implementing IFRS 9, the insights gained from the process and what the next stages might involve. This article explores the main themes covered in the…

Revolutionising credit decisioning in digital banking: harnessing AI/machine learning, LLM and alternative data sources

This webinar explores how financial institutions can leverage artificial intelligence, machine learning, large language models and alternative data sources, including open banking data, to modernise credit risk assessment and application fraud prevention

Navigating IFRS 9: strategies for effective implementation and moving beyond

There has been a constant change within the landscape of financial reporting, and IFRS 9 has been proven to be a critical component.

Navigating IFRS 9: strategies for effective implementation and moving beyond

There has been constant change within the landscape of financial reporting, and IFRS 9 has proven a critical component. Watch this webinar to find out how financial institutions can effectively implement IFRS 9 while remaining forward-looking and…

Unlocking the power of model ops for risk management gains

With banks coming under pressure to revisit risk models, many are now turning to model operations to bring much-needed improvements to every stage of the risk model lifecycle. A fundamental shift in the way risk models are developed, deployed, monitored…

Risk analytics are key to banks’ digital transformation

Market volatility and external influences are changing the way banks manage risk. SAS Australia explores how adopting digital transformation, alongside a dynamic and agile analytics-first approach, can provide banks with real-time data for identifying…

New BoE rules could force banks to cull multiplying models

Risk Live: Model risk management to become more labour-intensive, as model definition is broadened

ESG strategies special report

This Risk.net special report sponsored by SAS features a series of articles that reflect on the latest initiatives for consistent standardised global frameworks for measuring ESG, consider the methodologies investors are using to make measurable progress…

Digital exposure makes fraud management a vital responsibility for financial institutions

Fraud management and detection continue to be an increasing area of concern for financial institutions worldwide

Optimising balance sheet management in today’s market conditions

Financial institutions are going to continue struggling with challenges and volatility in 2023

Complying with climate risk framework standards for streamlined processes

Conscious that climate change affects all sectors of the economy, financial institutions are realising the significant impact this will have on their customers and, ultimately, their own profit margins.

Complying with climate risk framework standards for streamlined processes

Financial institutions worldwide are actively studying ways they can integrate climate risk management into their more traditional risk frameworks

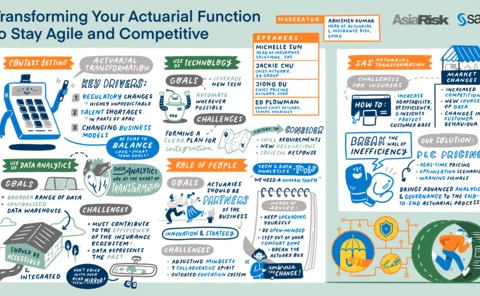

Transforming your actuarial function to stay agile and competitive

While transformation is important, its success depends on putting data in capable people’s hands

Decision science: from automation to optimisation

The full benefits of investing in a digital approach to credit decisioning are yet to be unleashed, despite advancements in automation and analytics at banks

Decision science: from automation to optimisation

Despite its benefits, credit decisioning is severely lagging – average ‘time to decision’ for small business and corporate lending at traditional banks is between three and five weeks, while average ‘time to cash’ is nearly three months

Mainstream crypto acceptance with regulation is inevitable, and that’s good

As banks increasingly adopt digital asset services, there remain inherent challenges getting institutions and customers onboard with crypto and its benefits. But the time left to overcome them is drawing to an end