Morgan Stanley

Fitch/Algorithmics deal analysis

New York-based global ratings and risk management specialist Fitch Group has acquired Toronto-based enterprise risk management software supplier Algorithmics for $175 million.

The importance of ALM

The crossfire between the International Accounting Standards Board and the European Commission seems to have left corporates bewildered about the implications of IAS 39. Risk talks to leading advisory groups and corporates about the challenges ahead, and…

Credit correlation model debuts on Bloomberg

Morgan Stanley’s credit correlation model has been made available on Bloomberg today. The model can be used to price basket and single-tranche credit derivatives.

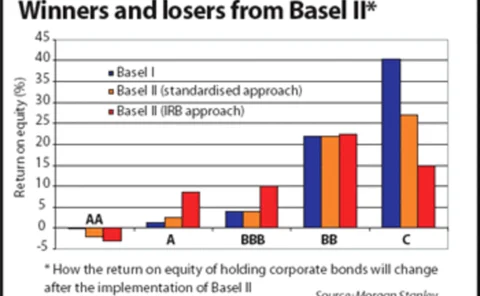

Basel II to boost bank bondholdings

Basel II could have a major impact on the bond markets, according to a new report from Morgan Stanley.

BNP restructures European credit research

BNP Paribas, the French banking group, has restructured its credit research division after three members were poached by Lehman Brothers in September.

DTCC expands matching and confirmation services

The Depository Trust and Clearing Corporation (DTCC) is to expand its matching and confirmation facility, dubbed Deriv/Serv, to include equity derivatives.

Merrill Lynch snaps up Entergy-Koch

Merrill Lynch is set to acquire the energy trading businesses of Entergy-Koch Trading (EKT), a venture of New Orleans-based Entergy Corporation and Wichita's Koch Industries.

Dollar/yen break-out expected

Technical indicators suggest the dollar/yen exchange rate could be set to break out of the tight trading range it has been trapped in since June, says RiskNews’ sister publication, FX Week .

Morgan Stanley Investment Management hires chief risk officer

Morgan Stanley Investment Management (MSIM) has hired Kenneth Winston as managing director and chief risk officer, reporting to the company’s president and chief operating officer, Mitch Merin.

Morgan Stanley quant joins Caspian Capital

Caspian Capital, a New York-based hedge fund specialising in fixed-income strategies, has hired Ali Hirsa from Morgan Stanley as head of analytical trading strategies.

Morgan Stanley Investment Management snares quant head

Morgan Stanley Investment Management (MSIM) has recruited Sandip Bhagat as managing director and global head of quantitative strategies. He reports to Joseph McAlinden and is based in New York.

Barclays poaches head of German fixed-income sales from CSFB

Omar Selim, formerly head of German fixed-income sales for Credit Suisse First Boston, is to join Barclays Capital.

Analysts learn to live with CP-205

The Financial Services Authority’s (FSA) new rules governing conflicts of interest in investment research could spawn a cottage industry in interior design tailored for research teams in dire need of CP-205 compliant office layouts. The CP-205 working…

Kemp takes foreign exchange helm at Merrill

Morgan Stanley foreign exchange chief Stephen Kemp is set to take on the continued build-up of Merrill Lynch’s forex business, following the resignation of co-head of global foreign exchange and rates Michael DeSa, reports RiskNews' sister publication FX…

Morgan Stanley poaches DrKW credit head in Tokyo

Morgan Stanley has hired Mark Mallia as an executive director to be the senior trader and product manager for US and European bond and credit default swaps in Asia time, according to Robert Breden, executive director in the fixed-income division of the…

Morgan Stanley set to acquire Barra

Morgan Stanley Capital International (MSCI), a provider of equity, fixed-income and hedge fund indexes based in New York, will acquire California-based technology company Barra within 120 days, for approximately $816.4 million, or $41.00 a share, the…

New York meeting brings iBoxx and Trac-x merger closer

The banks behind the iBoxx CDX credit derivatives indexes have agreed on points that could herald a merger between the index and its big rival, the Dow Jones Trac-x index, following a meeting in New York, reports Risk’s sister publication Credit .

Dembo steps away from CEO role as Algo secures new financing;

Ron Dembo, founder and chief executive of Toronto-based technology vendor Algorithmics, is to step away from his day-to-day running of the company to assume the role of chairman. The move comes as Algorithmics secured new financing from its main…

FX smashes $600m hole in Anglo accounts

The cost of failing to hedge foreign exchange risk was brought into sharp focus last week, when mining firm Anglo American said its 2003 earnings were down $578 million as a result of currency movements, reports RiskNews ' sister publication FX Week .

Creditex launches electronic trading of CDS indexes

Credit derivatives broker Creditex has launched electronic trading of credit default swaps (CDS) indexes.

Standard Bank takes on structured product marketers

Standard Bank London (SLB) has hired Rupert Boyd from Morgan Stanley and Michele Maffei from JP Morgan Chase for its sales and structured products marketing teams.

ABN Amro bolsters equities franchise in Hong Kong

Dutch bank ABN Amro has boosted its equities franchise in the Asia-Pacific region with a series of appointments in sales, trading and research in Hong Kong.

Morgan Stanley forex co-head retires

Morgan Stanley has made Philip Newcomb sole global head of foreign exchange, following the retirement of Peter Murray at the end of January, reports Risknews ' sister publication FX Week . Murray, who was based in London, and Newcomb, based in New York,…

US sets trend for high bonuses

Global commercial banks are expected to award bumper bonuses in the next three months, following a pattern set by the US investment banks in December, reports Risknews ' sister publication FX Week .