International Swaps and Derivatives Association (Isda)

Dealers eye model change to cure CVA capital headache

With hopes of EU regulatory carve-out fading, some banks are taking matters into their own hands

How Covid‑19 is impacting transition preparations

A forum of industry leaders, including the sponsors of this report, discusses key industry concerns around the transition away from Libor, including how the discontinuation deadline will be impacted by the Covid‑19 pandemic, the benefits and challenges…

Antitrust fears cloud Isda protocol – and fallback spreads

Wait for DoJ assurances could delay Libor transition plans and further unsettle rates trading

Beware of cliff edge in Libor fallbacks

Derivatives users may see a sudden change in the value of payoffs when Libor ends, Coremont analysts write

Libor webinar playback: Schooling Latter on timing of ‘death notice’

Benchmark cessation could be announced this year, FCA official reveals – news that has moved the market

Lagging futures market holding back swaptions RFR transition

“Elephant in the room” is hindering non-linear growth and swap market liquidity, say rates traders

Credit problem: SOFR faces uphill struggle in loan market

Furnishing Libor’s replacement with a credit-sensitive spread is proving to be a Sisyphean task

People moves: HKEX’s Charles Li to leave, new Isda directors, and more

Latest job changes across the industry

FRTB comes too late for Covid crisis

Expected shortfall would stop Basel 2.5 duplicate capital charges, but backtesting still a problem

After coronavirus rout, concerns raised about Simm

Annual recalibration means March volatility will not be reflected in margin until end-2021

EU banks seek FRTB delay, citing ‘strain’ of virus

Firms want leeway to fight market mayhem, minus burden of new reporting rules

Industry calls for suspension of IM compliance dates

Associations warn phase five deadline may no longer be possible for hundreds of buy-side firms amid Covid-19 disruption

Pre-cessation Ibor picture gets clearer

As the derivatives market has accepted the impending transition away from interbank offered rates, attention has turned to how best to manage it. Philip Whitehurst, head of service development, rates at LCH, explores how the clearing house is working…

Libor-SOFR blowout raises questions for fallback rate

Implied three-month SOFR v Libor basis gapped to 108bp on March 19

EC: No plans to delay IM phase five

EC official says Europe will go ahead with phase five initial margin requirements set to come into effect in September

Exchange shutdowns could trigger derivatives unwinds

Eight-day closure would invoke subjective valuation clauses; hedge disruption could cancel trades

China regulator to outline legal thinking on close-out netting

Coronavirus could delay things, but authorities are taking small steps on a thorny issue

Of rats and men: would member compensation imperil CCPs?

CCPs and members split over whether compensation after default losses is moral hazard or fair

India preps margin regime as parliament debates netting law

Lawmakers thrash out bill on close-out netting; margin rules likely to follow in H1

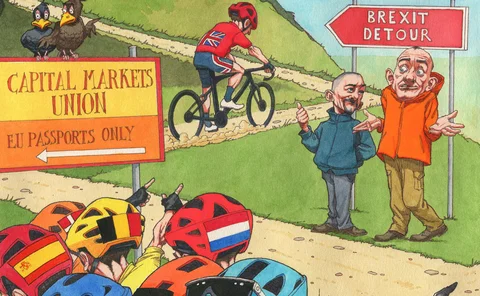

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Cross-border trading could suffer under IM rules

Conflicting US and EU cash reinvestment rules may force buy side to post bonds

Synthetic Libor faces legal obstacles

EU benchmark rules may thwart ‘tough legacy’ fix, reviving calls for blanket legislation

Margin exchange threshold relief: get out of jail free?

‘Game-changing’ IM exchange threshold relief may not be the phase five free pass it first appears

FCA dismisses Libor credit component concerns

UK regulator bemused by distress raised by US regional banks to Fed