Financial Conduct Authority (FCA)

Esma trains beam on investment fund risks

Officials look to regulatory reporting for better grasp of fund leverage and liquidity

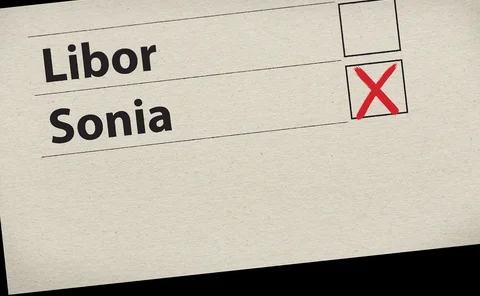

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

In the US, it’s an even ‘tougher legacy’ for Libor

A legislative solution for cash products is in the works, but lawyers say it raises constitutional issues

BMR rift fuels zombie Libor uncertainty

False rate could limp on for months under EU’s benchmark regulation

UK regulator issues plans for bank ops resilience

Bank of England to publish formal policy for recovering from disasters in 2020

The human touch: SMCR extension reaches smaller firms

Extended to nearly 50,000 firms, UK regime aims to pinpoint responsibility, from money laundering to #MeToo

Isda to poll Libor users on pre-cessation triggers, again

Trade body seeks clarity on zombie lifespan and CCP response as it bows to regulatory pressure

FCA steps up call for Libor ‘pre-death’ trigger in swaps

Failure to insert pre-cessation trigger could disrupt hedging of cleared swaps, warns regulator

HSBC’s Elhedery: banks must protect whistleblowers

Corporate culture must respect and reward complainants; compensation could help, says markets chief

UK swaps carrot for stick in Libor switch

BoE committee mulls policy action, which could include capital hikes on Libor exposures

FCA official: stick with overnight rates for all new contracts

Schooling Latter limits term rates to legacy contracts and wants backward-looking method for loans

Fund fears linger over guidelines set to avert fire sales

Final Esma framework allays some European asset managers’ concerns

Libor transition and implementation – Special report 2019

A critical halfway stage has been reached on the Libor transition journey – at least in terms of timing. It’s just over two years since the UK’s top financial regulator called notice on the discredited benchmark. It’s also just over two years until the…

Synthetic Libor mooted as ‘tough legacy’ fix

Recalibration of doomed rate or catch-all legislation under debate as lifeline for lingering contracts

FCA has active pipeline of misconduct investigations

As expansion of SMR to smaller firms looms, regulator says plenty of bankers are under scrutiny

EU seeks to offer reassurance on Brexit clearing exemption

Commission can act quickly to stave off no-deal market disruption, insists official

FCA urges dealers to quote Sonia swaps on Clobs

Regulator co-ordinates efforts to stream firm prices as part of ramped-up transition plans

FCA chief calls for EU to extend Brexit clearing exemption

Bailey also urges EU to grant equivalence determinations for UK trading venues

Libor takes a back seat as insurers await regulatory clarity

Eiopa silence on discount curves holds back transition plans

Splits emerge over ‘pre-cessation’ fallback triggers

CCPs say cleared swaps will move to new rates if Libor is no longer representative of markets

PPI claims take bite out of Lloyds’ capital

Bank says it received average of 150,000 PPI information requests per week in Q2

EU banks seek last-minute margin reprieve for equity options

European dealers want exemption rolled over, to avoid handing US firms a regulatory advantage

Regulators plan to delay IM ‘big bang’ – market sources

Most see final phase of initial margin rules coming a year later, in September 2021