Federal Reserve

US dollar Libor’s fate in doubt after IBA delays funeral plans

Decision to exclude US dollar Libor from cessation plan is being treated as effective extension

Liquidity buffers thinned at Morgan Stanley, Goldman in Q3

Build-up of HQLA slows over the third quarter after post-Covid surge

Regulators voice concerns over cloud risk

Risk USA: failure of big cloud service provider could cause “a very large shock”, says NY Fed exec

EU’s dividend ban overshadows reform effort

Banks may be reluctant to run down buffers even if regulators soften the MDA threshold for payouts

Quarles’ legacy Libor contracts plan stirs confusion

Cryptic comment feeds speculation about synthetic US dollar Libor – prompting pushback from ARRC

BofA the outlier as most US banks improve SLRs in Q3

Aggregate Tier 1 capital climbs 2% in Q3

NY Fed’s Stiroh: ‘cultural capital’ at risk in pandemic

Risk USA: remote working could “erode” the culture of financial firms, says senior regulator

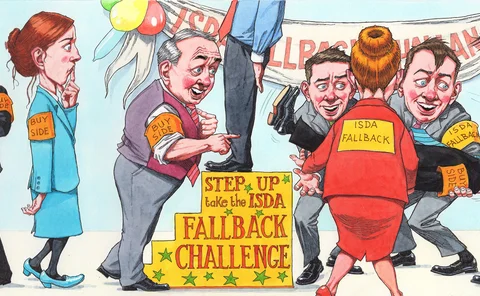

The buy side and Libor: it’s decision time

Investors weigh pros and cons of signing newly released Isda fallback protocol, as Libor demise looms

Asia’s private wealth giants shift gears to market-neutral

With interest rates low, structured product investors bypass capital-protected products for market-neutral strategies

G-Sibs see little sign of relief on Fed’s systemic buffer

Central bank liquidity and Treasuries will push US firms into higher G-Sib buckets

Top US-based foreign banks shrink systemic footprints

US units of Barclays, Credit Suisse and Deutsche Bank have cut assets 40% since Q3 2016

Congress readies surprise ‘tough legacy’ Libor fix

Federal legislation to ensure legacy Libor contracts can move to SOFR is in the works

Op risk data: Firm-wide control fails cost Citi $400m

Also: Deutsche draws fire and AML fine over Danske trades. Data by ORX News

Joe Biden’s slow road to remaking US financial regulation

Moves on climate risk could come early; other changes may have to wait until end of 2021, or later

Basis trades: a test case for regulating risky activities

FSOC is right to focus on dangerous behaviour, but Treasury meltdown reveals a complex chain of actors

Banks fold climate, pandemic and cyber risks into CCAR

OpRisk North America: anchoring idiosyncratic risks to macro scenarios a challenge, say experts

Jerome Kemp on the skewed economics of clearing

Only Fed intervention prevented “a really big market disaster” during Covid, says derivatives veteran

US election scenarios: meltdown fears if poll contested

Crowdsourced election scenarios show sharp falls and correlation breaks if Trump challenges results

Bailed-out basis traders face regulatory backlash

The cash/futures basis trade could be a test case for regulating systemically risky activities

BNP Paribas grew share of MMF Treasury repo over Q3

French bank accounted for 13% of traded volume as of end-September

Fed set to unveil operational resilience proposals

OpRisk North America: banks expected to design idiosyncratic stress scenarios to test resilience

CME asks clients about changing implied UST futures coupon

Falling yields prompt review of 6% conversion factor for delivery-eligible bonds

Covid policy risk hangs over bank stress tests

Banks and regulators are second-guessing the policy response to new outbreaks

Regulators seek harmony on op resilience rules

Alignment on principles needed “in short order”, says Basel working group chair