European Securities and Markets Authority (Esma)

SFTR confusion over Esma’s coronavirus delay

European regulator’s announcement fails to tackle how delay affects legacy transactions

Banks think SFTR delay a ‘done deal’ amid virus outbreak

Industry letter urges regulators to postpone first two phases of reporting until October

Spot FX could be dragged into Mifid II

EC tells Risk.net it is studying Australian-style approach to regulating currency trading

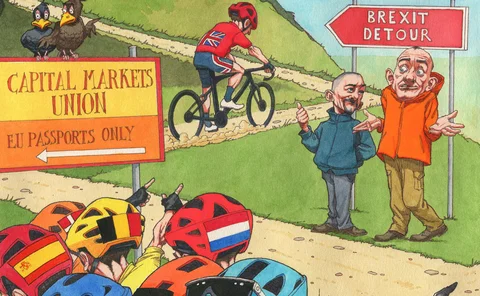

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

€5trn of Eonia swaps mature after benchmark’s death

Almost 20% of derivatives notionals linked to retiring rate will expire post-2022

‘Fallen angels’ pose little threat to EU funds

Passive fund outflows in a credit crisis would put pressure on high-yield bond prices

New Mifid equivalence rules leave UK firms in limbo

Revised market access rules won’t kick in until six months after UK leaves single market

Non-EU hedge funds stage surprise escape from SFTR

European Commission clarifies scope of reporting obligation that confused many in the industry

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Worth the cost? EU rethinks Mifid disclosure rules

Banks would gladly be rid of cost disclosures, but some clients want them improved, not scrapped

Esma trains beam on investment fund risks

Officials look to regulatory reporting for better grasp of fund leverage and liquidity

Hedge funds levered up in 2018

Relative value funds have highest adjusted leverage, at 7,155%

Liquidity risks acute for popular retail funds – Esma

Eight per cent of real estate fund NAV may be withdrawn over a one-day period

European CCPs home to 241 non-bank clearing members

Majority of non-financial counterparties are energy and power firms

Mifid’s free data mirage vexes markets

Users struggle to access post-trade data despite European regulator’s push for transparency

Germany scrambles to shut the door on Mifid open access

Finance ministry will face fine timing to reverse clearing rule during its EU presidency

EU derivatives markets highly concentrated

CCPs hold 41% of interest rate derivatives notional exposures

Clearing experts fear tough EC stance on Emir 2.2

Industry disappointed final Esma advice did little to dial back on burdensome equivalence rules

People moves: CRO Landy takes helm at Brevan, SocGen names new Asia chief, Murray out at Bridgewater, and more

Latest job changes across the industry

Why Europe’s markets might need Mifid III

Lawmakers leaning towards small-scale review, others call for fuller rewrite

EU to grant last-minute margin reprieve for equity options

European Commission to publish changes to Emir technical standards within days

Robo-raters help banks vet vendors for cyber risk

Specialists tout service for monitoring third parties amid tougher rules on outsourcing risk

Frandt or foe? FCMs hit back at Esma buy-side clearing salvo

Esma pushes dealers to publish standardised fee schedules amid clearing capacity fears