European Investment Bank (EIB)

No clearing sweeteners for European SSAs, argue dealers

As public entities eye CCP membership, dealers warn of heightened risk exposure from support waivers

How sovereigns learned to live with two-way CSAs

Some say new collateral terms ensured access to markets during last year’s meltdown

Bonds and loans clash on Sonia compounding style

Choice of ‘lag’ method for sterling RFR loan conventions bars use of BoE index

Libor leaders: EIB sees prizes and pitfalls in Libor reform

Sonia bond trailblazer wants a single bond template for all RFRs, but found hidden devils in its debut

Brexit, EU regulation and a new benchmark

The week on Risk.net, July 28-August 3, 2018

Fed’s Quarles critical of opaque Libor data

ARRC chair Sandra O’Connor also questions IBA transparency

EIB shrugs off term RFR worries with Sonia bond plan

Issuer to use daily compounded, backward-looking rate with time lag for sterling benchmark

BBVA gets capital relief through synthetic securitisation

Second deal with European Investment Bank frees up balance sheet for lending

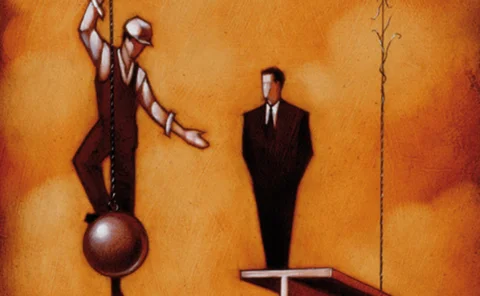

Unskewed incentives: making governance work

EIB model head explains a four-step process for putting risk at the centre of governance efforts

EU rapporteur says Mifid II is ‘too complicated’

Bankers claim new rules “trap liquidity”

EIB credit enhancement lures UK insurers to project bond

Capital efficiency of A3 bond tempts insurers

Insurer participation in testing European project bond debut ‘exceeds expectations’

Long maturities and improved rating lure firms into Spanish gas scheme bonds

ALM Europe: Basel right to rein in capital models, says EIB exec

Regulators should be more intuitive in their approach to capital levels, EIB treasury risk head tells conference

German insurers warn of Solvency II threat to infrastructure investment

Insurers keen to invest in real economy, finds BaFin study, but regulatory uncertainty holding them back

Legal & General eyes European infrastructure finance bonds

European Investment Bank set to launch project bond pilot scheme in September

US banks could lose competitive edge in Europe, says EIB

US regulations on mandatory clearing and uncleared margin could put US dealers at a competitive disadvantage in Europe, says EIB

More sovereigns edge towards two-way CSAs - and clearing

Towards two-way CSAs

Dealers predict CVA-CDS loop will create sovereign volatility

A recipe for disaster?

EIB to sell 300 million carbon units

European Investment Bank plans to sell 300 million EU carbon allowances

Bargagli-Petrucci says bye-bye to EIB

Bargagli-Petrucci says bye-bye to EIB