European Commission (EC)

Long-term guarantee measures must be flexible - Balz

Solvency II calibrations need to account for different national contexts

PRAs under attack amid market manipulation investigations

Price reporting agencies (PRAs) are facing intense scrutiny from regulators, amid renewed allegations that their widely used price indexes are being manipulated by unscrupulous energy traders. Will the PRAs be forced to change their ways? Alexander…

Asian CCPs left to apply ‘in the dark’ for Esma recognition

Asian CCPs under pressure from EU third-country equivalence/recognition deadline squeeze

Insurers call for more transparent infrastructure investments

Structuring and regulation of assets frustrating investment, say market participants

AIFMD regulation more suitable for some strategy ETFs, says EC official

EC asset management head proposes regulation of some strategy ETFs under the Alternative Investment Fund Managers Directive, instead of Ucits

EC recognises member state fears that FTT will hurt clearing

Tax liability could send CCPs "directly into insolvency" warn Czech officials in leaked document

Japan delays cross-border rules amid US and European uncertainty

Equivalence and substituted compliance issues must be resolved quickly, or financial markets will be affected, says Kono at Japanese FSA

EU financial transaction tax may drive Asian banks away from European business

Eleven EU states have agreed to implement a harmonised financial transaction tax, due to begin in January 2014. The tax has a huge extraterritorial reach, posing serious questions about its impact on Asia

Drop in Hong Kong Prada share volume highlights dangers of transaction taxes

Daily turnover in Prada shares listed on Hong Kong Exchange has dropped by over 30% since introduction of Italian financial transaction tax two months ago

Europe should consult on Emir equivalency – SEC official

The EC and Esma should consult on the process for determining equivalency with Emir, says Eric Pan of the SEC

Financial transaction tax will harm Europe’s banks in Asian derivatives markets

The draft form of the EU's proposed financial transactions tax is 'unworkable' for European firms operating in Asia

Mandatory bundling will damage trading in European gas, say firms

Capacity Allocation Mechanism network code could restrict gas trade at physical hubs and interconnection points

Risk Espana rankings 2013

Spanish fiesta turns cold

Better risk data vital if insurers to boost disaster coverage

Steps to improve risk modelling needed if Europe wants insurers to increase cat risk exposure, say experts

US warns EU over financial transaction tax

The US will not allow the EU financial transaction tax to happen, according to the head of US Chamber of Commerce Thomas Donohue. Co-ordination between G-20 countries on financial regulation is needed

Finance ministers warn US on extraterritoriality

Letter to US Treasury secretary says OTC rules should be applied within national borders only. Signatories include French, German, UK finance ministers

Van Hulle: Long-term investment agenda must not side-track Solvency II

Political focus on promoting long-term finance could be detrimental to insurance industry, warns European Commission's former Solvency II leader

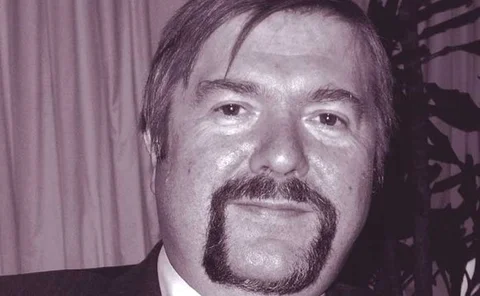

Q&A: Karel Van Hulle on Solvency II delays and the challenges ahead

Beating the negative forces

EC to fight new US prudential rules for foreign banks, says EBF

EC "very concerned" about capital and liquidity proposals, says chief executive of the European Banking Federation

Solvency II equivalence rules must not threaten European insurers - Skinner

Rules must not cause 'ill effects' to firms with international business, warns senior MEP

Uncertainty over Emir may force European banks from some Asia OTC markets

The deadline is approaching for regulators to establish what European banks can clear and where on Asian CCP platforms ahead of OTC market standards going live from March 15

Commission's Van Hulle to be succeeded by procurement lawyer

European Commission confirms new head of insurance and pensions unit

EU ETS faces back-loading test

A critical condition