EY

Consultancy of the year: Ernst & Young

Enterprise-wide focus is the wave of the future, consultants find

Singapore positions itself as OTC clearing hub for Asia

Clearing link with KRX will lead to larger volumes and efficiencies at SGX

LGT Capital Partners opens China office

People moves

Rise in CCPs may spur collateral fragmentation

Currency controls

FSA’s cyber resilience review ‘may reveal shortfalls’

Review of 30 financial institutions will lead to first new guidance in seven years

Chilean insurers grapple with risk-based capital assessment

New framework will challenge domestic insurers, experts warn

EU proposals give banks greater enforcement role, expert says

European Commission plans to expand anti-money laundering legislation

Proposed derivative restrictions for Singapore insurers to have a limited impact

New MAS proposals to unify investment guidelines for all insurers, and in doing so limit derivatives usage, will not affect existing investment policies for insurance firms

Solvency II transitional measures come under fire

Concerns about costs and suitability of phase-in of capital charges

Hong Kong retirement funds may be exempt from Fatca

The largest pension schemes in Hong Kong can potentially be exempted from Fatca after being judged by the US to be low risk for tax evasion

Dodd-Frank will hit Asian banks onshore in the US

Dodd-Frank will require some foreign banks to set up intermediate holding companies for their US operations and also subject them to enhanced liquidity, supervision and stress testing. How will Asian banks be affected given the flow of US dollars from…

RDR fees still not clear for clients, experts warn

Clients still in the dark about RDR fees despite January 1 deadline passing

Asian currency hedgers to be hit by ‘fatal flaw’ in new accounting rules

A major change is needed to correct new hedge accounting rules, which could restrict derivatives use by Asian firms hedging their foreign currency exposures

Collateral Management Survey 2012: insurers unprepared for OTC cleared regime

The move to central clearing of OTC derivatives trades will have a dramatic impact on the insurance industry’s use of collateral. A survey, conducted by Insurance Risk in conjunction with BNY Mellon, finds many insurers have yet to assess fully the…

Basel III and Islamic finance: friend or foe?

Faith in the system

Australian banks well placed to meet new Apra liquidity reporting standard

Tougher liquidity reporting standards imposed by the Australian regulator won't be a problem for the country's four main banks

Philippine early implementation of Basel III capital ratios politically motivated

The decision to bring full Basel III compliance in five years ahead of the final deadline is based on politics rather than economics, according to one risk manager

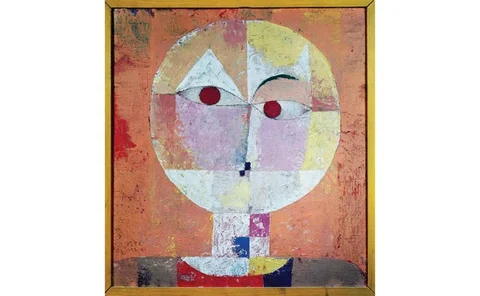

Consultancy of the Year – Ernst & Young

Asia Risk Awards 2012 winner: Ernst & Young – Consultancy of the Year

FSA flexing its muscles with RDR letter, observers say

A "Dear CEO" letter from the FSA on RDR is seen as a harbinger of its new interventionist stance

Systemic risk methodology continues to worry insurers

Punitive reform

Barnier proposes delay to Omnibus II vote

Commissioner proposes waiting for results of impact study on long-term guarantees in March 2013

Fatca reciprocity agreement may cause delays, experts warn

US firms expected to push back on Fatca quid pro quo