Depository Trust & Clearing Corporation (DTCC)

DTCC members add $26bn to default funds in 2018

Clearing house's own contributions dipped $8.5 million last year

Digital Asset’s European chief set to exit

Departure from blockchain firm follows other top exits in last few months

Functional programming reaches for stardom in finance

Fans highlight more reliable code, and suitability for complex tasks and distributed ledgers

FICC takes firm grip of US repo market

Central counterparty wrangled more money market repo cash than banks did by end-2018

DTCC, Ice Clear Europe lead top CCPs in boosting liquidity buffers

CCPs added $20.8 billion to their liquidity buffers in the third quarter of 2018

Repo rate hits 7.25% on year-end volatility

US Treasury issuance on December 31 said to have fuelled last-minute dash for cash

Top 10 CCPs plump liquidity buffers by $20 billion

Increase driven by higher secured deposits at commercial banks and expansion of credit lines

NSCC posts $137m margin breach

Securities CCP records largest margin shortfall since public disclosures began

Unfinished business: US Treasuries reform stalls

Efforts to improve clearing and settlement of US government debt – and oversight of who trades it – still incomplete

FICC concentration risk ebbs

Open positions in government securities held by ten largest clearing members falls to 37%

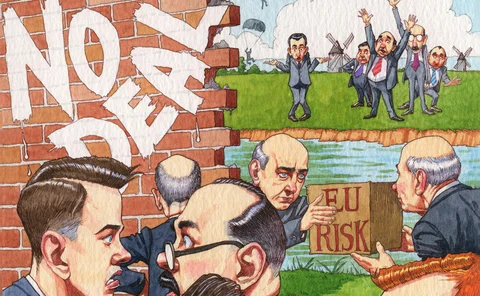

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

Hackathon finds pre-trade gold in Isda’s post-trade project

Dealers’ derivatives trade processing costs could be cut by at least $3 billion per year

Risk.net podcast: DTCC’s Lind on FRTB, data pooling and NMRFs

As many as 70 banks globally could adopt internal model approach for market risk capital

CCPs build their liquidity buffers

$26 billion increase in deposits entrusted to commercial banks

FICC liquidity facility swells to $36 billion

Capped contingent liquidity facility adjusts in response to heightened liquidity risk

New DTCC fee structure could lure non-bank traders

US regulator approves proposal targeted at government securities business

CCPs must step up cyber risk efforts, says EU legislator

Policymakers want more focus on non-default loss resources; Eurex Clearing’s Mueller flags investment risk

CCPs incur fewer margin breaches in 2017

LCH Ltd reports 399 fewer breaches than in 2016; DTCC 156

Liquidity resources vary across CCPs

Eurex, Ice Clear Credit, LCH SA most dependent on cash deposited at central banks

FRTB: Nordic banks mull regional data pool

Local tie-up could “prevent big banks entering the markets in the Nordics”, says local risk manager

CME has chance to rule US rates after Nex deal

Market expects exchange to unite bond, repo, futures and swaps clearing – eroding grip of banks and DTCC

CCPs hike spending on cyber defences

“The thing OCC spent the most incremental funding on in 2017 was improving cyber security,” says COO

Global fragmentation looms in FRTB data pooling stand-off

Smaller banks unwilling to hand over localised trade information to data utilities