Deutsche Bank

Renminbi splurge lifts BNPP, MSIM in Q1 options data

Counterparty Radar: Morgan Stanley IM is largest options user, following series of huge renminbi calls

Deutsche sees equity RWAs jump 29% on new EU rules

CRR II requires banks to calculate exposure they would incur to honour guaranteed returns on investment products

Cleared portfolios surge at EU G-Sibs

Systemic banks post highest share of cleared trades in seven years, as IM phases five and six approach

Deutsche takes €17.7bn RWA add-on in final Trim hit

Leveraged loan portfolio among targets of ECB’s remedies

Crédit Agricole grew OTC derivatives notionals 17% in 2020

Bank pulls ahead of SocGen as third-largest European derivatives bank but risks incurring a higher G-Sib score

EU banks get first taste of new stress test-driven buffer regime

Of the 50 stress-tested lenders, three would fall into the highest Pillar 2 Guidance bucket

EU stress tests: market risk cuts 107bp off average bank’s CET1

SocGen, Deutsche and UniCredit the hardest hit among EU systemic banks

After Archegos, prime brokers put the squeeze on hedge funds

Hedge funds are told they will need to pay more margin, more frequently, to back their trades

Archegos report details margin failings at Credit Suisse

Dynamic margining and a $150,000 software fix for ‘bullet swaps’ could have saved the bank $3 billion

People moves: Credit Suisse taps Goldman for new CRO, and more

Latest job changes across the industry

Euro RFR group calls for statutory Eonia fix

Legal designation for €STR as replacement rate would avert “confusion” in €9trn of legacy contracts

The race to digital resiliency – Building a robust data management framework

Addressing privacy concerns is not a new topic for data and analytics, but with the explosion of regulations and growing consumer concern around how data can and cannot be used, addressing compliance requirements is more important than ever

Foreign banks perform better in 2021 Fed stress tests

Intermediate holding companies reported higher post-stress capital and leverage ratios than their US peers did

Fed stress tests stretch Goldman Sachs, HSBC

US dealers toe binding minimums in latest DFAST exercise

Asia moves: Deutsche appoints Asia-Pacific treasurer, Citi boosts Australian sales team, and more

Latest job news across the industry

Deutsche leads eurozone banks on exempted exposures

German bank increased central bank reserves currently excluded from leverage ratio the most in Q1

From one extreme to another: Covid upsets loan models once more

Unusual economic slumps tripped up models in 2020. Now, they are struggling with fast recoveries

How time-step stress-testing helped Deutsche navigate Covid

Market risk chief touts importance of repeat stress-testing over point-in-time methods

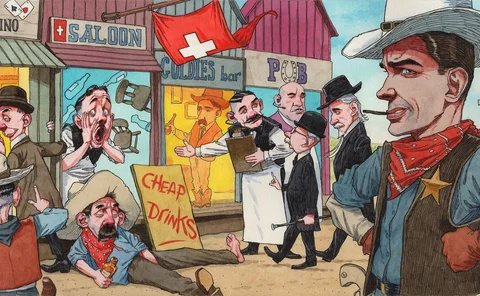

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Op risk data: Money laundering gaffes cost ABN €480m in penalties

Also: Turkish crypto exchange’s missing $2bn; online payment scams rise during Covid. Data by ORX News

UniCredit cut RWAs the most of EU systemic banks in Q1

The €10.8 billion cull helped improve the Italian bank’s CET1 ratio 52bp

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Deutsche slashed market RWAs by one-fifth in Q1

Macro-hedging touted as RWA-saving tool

Derivatives footprint of top EU banks shrinks

Deutsche Bank reduced these exposures by 12% alone