Bank of America

Six US banks grow systemic footprints

BAML and Citi climb into higher G-Sib surcharge buckets

Issues of unsecured debt, CDs pick up steam at US G-Sibs

Senior unsecured debt amounts outstanding climb 31% on Q4 2014; CDs 45.5%

First-half trading revenues at US G-Sibs increase by a third year-on-year

Income from interest rate exposures more than tripled on H1 2018, while equity revenues increased 17%

Cleared swaps surge $6.6trn at US G-Sibs in Q2

Cleared swaps accounted for 54% of G-Sib notionals in Q2

At US G-Sibs, swap payments make up $178bn of LCR outflows

All bar one G-Sib see net derivatives cash outflows increase year-on-year

Liquidity coverage at US G-Sibs worsens in Q2

HQLA rose $18bn while projected net cash outflows jumped $29bn

State Street, Goldman push VAR limits the most

Average of largest trading losses-to-VAR at State Street above 90% over past 12 months

Two US dealers grow appetite for counterparty risk

JP Morgan sees risk weight of portfolio climb to 41.5%

At US G-Sibs, market RWAs fall $18bn in Q2

Fall in VAR-based measures of risk behind the decrease

State Street had most losing trading days since 2015 in Q2

Systemic US banks rack up 220 losing days in second quarter

US G-Sibs’ TLAC buffers vary

Morgan Stanley and Goldman Sachs have eligible TLAC equal to 50.8% and 44.7% of RWAs, respectively

Citi’s swaps clearing unit boosts client margin by $2bn

The largest FCM accounts for 27.1% of all required client margin

To be resolved: inside banks’ ‘living wills’

Non-bank units and service providers make up large share of groups’ critical functions

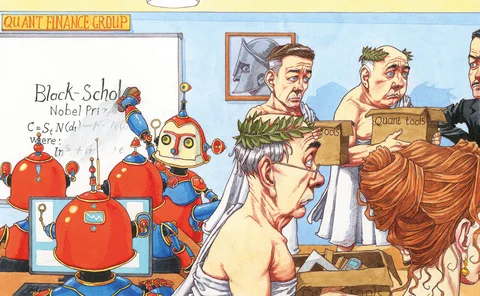

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

‘Living wills’ show some G-Sibs will be simpler to resolve

Four big banks reported fewer wind-up entities in 2019 resolution plans compared with 2017

Post-CCAR share buybacks up 30% for US G-Sibs

Dividend up 18% on average following latest stress test cycle

Capital issue boosts BofA’s AT1 capital by 11%

The bank issued two slugs of perpetual preferred stocks in Q2 2019

‘Bad banks’ through the ages

How Deutsche Bank’s latest resolution unit stacks up

DFAST: JP Morgan accounts for one-fifth of projected losses

Bulk of losses would come from bank’s loan portfolio, projected to incur total losses of $60.3bn

Non-systemic US banks shy away from short-term funding

Mid-sized non-G-Sibs have average STWF score of just 17.1%

RWA density at JP Morgan drops to six-year low

Bank’s asset portfolio has become less risk-heavy under standardised approach since 2013

Goldman Sachs leads US firms on non-bank assets

Non-bank assets of G-Sibs equivalent to 32% of total consolidated assets

US mid-sized banks pile into intra-financial system assets

Non-G-Sibs over $100 billion in size hold 85% more of other banks’ assets than in 2014

US banks’ liquidity buffers thinnest among G-Sibs

Mean LCR of US banks hits 122.5% in Q1