Archegos

NatWest’s PB chief on not changing course after Archegos

Marcus Butt believes diversity of clients, both in size and type, is the best way to manage risk

After Archegos, a bigger role for XVA desks?

Credit Suisse has stalled on call to expand XVA remit; others think it would have helped, but disagree on how

People moves: Credit Suisse senior shake-up, and more

Latest job changes across the industry

Stronger together: CLS’s chief risk officer on risk culture

Deborah Hrvatin discusses integrated risk management, mega-hacks and model risk

Client margin down 33% at Credit Suisse’s swaps unit in Q2

Drop in IM could signal clients jumping ship in the aftermath of Archegos blowout

The unintended consequences of ring-fencing

Rules aimed at protecting UK depositors may be putting too much froth into the credit market

Archegos report details margin failings at Credit Suisse

Dynamic margining and a $150,000 software fix for ‘bullet swaps’ could have saved the bank $3 billion

People moves: Credit Suisse taps Goldman for new CRO, and more

Latest job changes across the industry

Credit Suisse’s op risk up $6.5bn on subprime-era litigation

Increase offsets the removal of Archegos-related capital add-on by Finma

UBS incurred two VAR breaches in Q2

Risk Quantum understands the VAR backtesting exceptions stemmed from the Archegos blowout

Could global regulators miss another Archegos whale?

Spotting systemic risk from OTC swaps requires cross-border access to derivatives data

Hedge funds and the rebound in collateral velocity

Reuse rate of collateral points to growing fragility and interconnectedness in financial markets

Archegos raises questions about Hong Kong listing rules

Deference to US disclosures stopped Baidu’s Hong Kong listing shining a spotlight on Archegos

Finma add-on inflates Credit Suisse’s credit RWAs

The Sfr5.8 billion additional capital buffer accounts for two-fifths of bank’s quarterly increase

Nomura hires McKinsey to examine Archegos failings

Risk framework under external review as DOJ reportedly opens probe into fund’s collapse

Trouble in the family: regulators’ options after Archegos

What rule changes are needed in response to the messy collapse of Bill Hwang’s firm?

Could an Archegos blindside banks in Europe? Not really

Archegos’ banks were burnt by its hidden US swaps – in much of Europe, they would have to be public

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

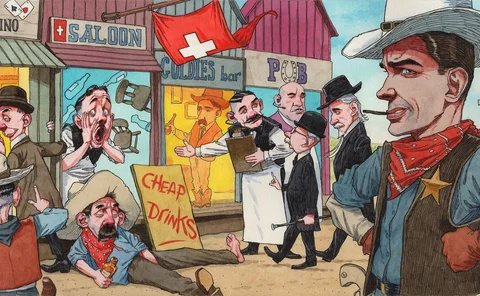

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

BNP Paribas’ VAR hit 12-year high in Q1

Equity portfolio VAR surged 27% quarter on quarter

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Risk management is not a job for compliance

Credit Suisse losses show why boards require real risk management expertise, says ex-BoE supervisor

Trading VAR at UBS peaked after Archegos blow-up

Swiss bank still posted a fall in market RWAs quarter on quarter

Archegos debacle prompts Credit Suisse to slash prime services

Executives pledged $35 billion of cuts to investment bank leverage exposure