Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Data consolidation is a vital element of risk management. Without it, analytic models will produce inaccurate and misleading results, and flexible reporting and ‘slicing and dicing’ of data will not be possible.

Risk measurement and management refers to the methodologies used to calculate risk. These include mark-to-market, value-at-risk (Var), stress testing, scenario analysis and other functionality required to support an organisation’s risk strategy and policies.

The key challenge is choosing the most appropriate risk methodology and ensuring that the underlying calculations are transparent. The organisation must also dedicate time to testing and building confidence in the models. This task is likely to involve significant reconciliation with spreadsheet models during the early stages of the implementation.

Finally, a flexible reporting architecture is critical to ensure appropriate reporting to all levels of the organisation. This could take the form of Microsoft Excel or Access reports or the richer functionality of a dedicated third-party reporting tool.

We are starting to see a shift in thinking on the data consolidation front. Organisations are recognising that they need to be smarter with their IT capabilities to keep up with the markets. Meanwhile, risk management remains central to an organisation and becomes more critical as a business diversifies and evolves.

For many organisations, there is no single, holistic system that will meet all front-, middle- and back-office requirements. Hence companies are increasingly seeking a ‘best-of-breed’ solution that incorporates components from several applications supported by a common technical architecture.

It is no surprise to see companies choosing solutions comprising a number of ‘components’. Despite significant investment by trading and risk management software vendors, they have found it difficult to come up with a single, integrated, end-to-end system that meets all client requirements, due to the bespoke requirements of each business.

Mohamed Mansour, senior director at software supplier and consultancy The Structure Group, echoes this view. But he warns that the road to a flexible architecture is full of challenges. “Of course, flexibility doesn’t come easily, but a well devised and implemented technical architecture can prove an invaluable asset in today’s dynamic and highly competitive markets,” he says.

All this takes time, and yet it is no longer acceptable to wait one to two years for a system to be implemented. It is often necessary to get something up and running quickly to justify the expenditure and start building confidence in the solution. Solutions that take more than twelve months to implement are often out of date by the time they reach the end-user.

And in their eagerness to keep up to speed, all too often companies have dumped their existing solutions without recognising their importance as a component in the overall system architecture. Yet most of the challenges in creating any system infrastructure lie in ownership, implementation and the ongoing maintenance of data.

And solution maintenance isn’t just the IT group’s responsibility. Ultimately, maintenance starts with the users. There is no solution on the market that will magically transform a business without appropriate care and attention – you only get out what you put in.

| Case study: trading firm looks to report counterparty exposure |

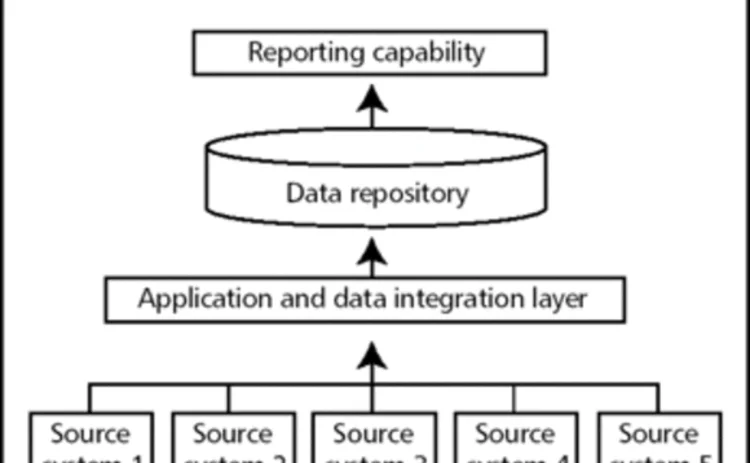

| An example of the issues facing the industry is a trading organisation that was unable to effectively report its risk across different markets and across counterparties. The organisation was facing increased scrutiny of its credit risk exposure – both internally and externally – and needed a solution that would enable it to report exposure by counterparty in a timely and accurate manner. The organisation’s solution architecture comprised a vast array of spreadsheets and systems. The company stored its trade data in an under-utilised trading and risk management system and in bespoke spreadsheets, maintained its counterparty information in separate back-office systems and housed its market data in a series of evolved spreadsheets and market screens. The consolidation of market data presented the organisation with another challenge, particularly in less mature markets, where it is not always possible to obtain clean set of reliable market data. A further problem was that different sources were presenting the market data in different formats, such as absolute and relative time buckets. The company required a system that retained the benefits of their current solution, but increased its ability to consolidate – and so report – this data on an enterprise-wide level. The main challenges the firm faced, then, were standardising the data across disparate systems and integrating the components within their budget and timescales. The diagram shows a high-level representation of the client’s new technical architecture. The software supplier adopted a pragmatic approach when deciding which systemsbased on the most pressing reporting requirements. The vendor overcame the issues surrounding market data by subscribing to multipleinformation sources, standardising this data and consolidating it into the datarepository. The supplier built logic into the solution so that missing data was ‘filled-in’ basedon a number of pre-defined rules set by the client’s business. The new solution has greatly enhanced the organisation’s reporting flexibility,enabling it to gain an accurate picture of risk exposure across commodities,counterparties and geographic regions. |

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Technology

What is driving the ALM resurgence? Key differentiators and core analytics

The drivers and characteristics of a modern ALM framework or platform

Are EU banks buying cloud from Lidl’s middle aisle?

As European banks seek to diversify from US cloud hyperscalers, a supermarket group is becoming an unlikely new supplier

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market

AI ‘lab’ or no, banks triangulate towards a common approach

Survey shows split between firms with and without centralised R&D. In practice, many pursue hybrid path

Everything, everywhere: 15 AI use cases in play, all at once

Research is top AI use case, best execution bottom; no use is universal, and none shunned, says survey

FX options: rising activity puts post-trade in focus

A surge in electronic FX options trading is among the factors fuelling demand for efficiencies across the entire trade lifecycle

Dismantling the zeal and the hype: the real GenAI use cases in risk management

Chartis explores the advantages and drawbacks of GenAI applications in risk management – firmly within the well-established and continuously evolving AI landscape

Chartis RiskTech100® 2024

The latest iteration of the Chartis RiskTech100®, a comprehensive independent study of the world’s major players in risk and compliance technology, is acknowledged as the go-to for clear, accurate analysis of the risk technology marketplace. With its…