News

Liquidnet sees electronic future for grey bond trading

TP Icap’s grey market bond trading unit has more than doubled transactions in the first quarter of 2024

FICC takes flak over Treasury clearing proposal

Latest plans would still allow members to bundle clearing and execution – and would fail to boost clearing capacity, critics say

Buy side would welcome more guidance on managing margin calls

FSB report calls for regulators to review existing standards for non-bank liquidity management

Citi halves swaptions book with US retail funds

Counterparty Radar: Mutual funds and ETFs cut exposures by 22% in Q4

CDS review seeks to tackle conflicts ‘elephant’

Isda AGM: Linklaters proposes overhaul for determinations committee - including independent members

People: Isda taps four new directors, O’Callaghan joins CA, Berlinski quits Goldman, and more

Latest job changes across the industry

Industry calls for major rethink of Basel III rules

Isda AGM: Divergence on implementation suggests rules could be flawed, bankers say

Saudi Arabia poised to become clean netting jurisdiction

Isda AGM: Netting regulation awaiting final approvals from regulators

Buy side looks to fill talent gap in yen rates trading

Isda AGM: Japan rate rises spark demand for traders; dealers say inexperience could trigger volatility

JP Morgan’s new way to trade FX overlays

Hybrid execution method allows clients to put dealers in competition via a single trading agreement

Japanese megabanks shun internal models as FRTB bites

Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

CFTC chair backs easing of G-Sib surcharge in Basel endgame

Isda AGM: Fed’s proposed surcharge changes could hike client clearing cost by 80%

Pension funds eye 30-year Bunds as swap spread tightens

Long-dated bonds continue to cheapen versus euro swaps, and some think they might fall further

Benchmark switch leaves hedging headache for Philippine banks

If interest rates are cut before new benchmark docs are ready, banks face possible NII squeeze

UK investment firms feeling the heat on prudential rules

Signs firms are falling behind FCA’s expectations on wind-down and liquidity risk management

Market for ‘orphan’ hedges leaves some borrowers stranded

Companies with private credit loans face punitive costs from banks for often imperfect hedges

Morgan Stanley back on top for US insurer FX forwards trades

Counterparty Radar: Bank added $1.7bn with Mass Mutual in Q4 to overtake Citi as biggest dealer

Pension schemes prep facilities to ‘repo’ fund units

Schroders, State Street and Cardano plan new way to shore up pension portfolios against repeat of 2022 gilt crisis

Euronext microwave link aims to cut HFT advantage in Europe

Exchange plans to level playing field between prop firms and banks in cash equities with cutting edge tech

Industry warns CFTC against rushing to regulate AI for trading

Vote on workplan pulled amid calls to avoid duplicating rules from other regulatory agencies

Crédit Agricole hires head of USD swaps and UST trading

John O’Callaghan joins French bank in New York from Garda Capital

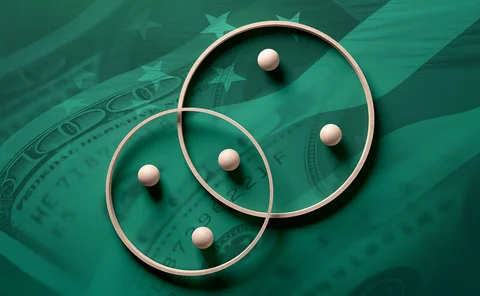

As dispersion hikes in price, equity traders slice and dice

Banks tout alternative versions of relative value vol strategy, including reverse dispersion

Bank of Communications moves early to meet TLAC requirements

China Construction Bank becomes last China G-Sib to release TLAC plans

Doubts dog equity dispersion as market grows up to five-fold

Some say $500 million vega notional – or more – in popular equity derivatives trades could be dampening volatility