News

PanAgora uses NLP to cut through Chinese cyber speak

Fund builds Mandarin-reading algo to gauge sentiment of retail investors

Sterling RFR group urges Eiopa to end mismatch on rates

In letter, group points to discrepancy in requirement to use Libor-linked rates as Libor fades out

Resampling ‘slashes’ credit risk VAR underestimates

Academics claim Vasicek model’s underestimation tendency can be slashed to near-zero

Regulators plan to delay IM ‘big bang’ – market sources

Most see final phase of initial margin rules coming a year later, in September 2021

Swaptions face valuation hit on discounting switch

Move to new reference rates could hurt some swaptions holders, while others enjoy “windfall gain”

Debelle swings at ‘buyer beware’ disclosures in FX

“They don’t give you free licence to do whatever you want,” says new GFXC chair

Swaps counterparties spooked by Emir position pairing

Stumble on voluntary position reporting could undermine push to reform ETD regime

S&P resists mapping new China onshore ratings to global scale

Uncertainty over state support and accounting prompts agency to keep Chinese ratings separate

AQR takes step into exotic trend following

$200-billion quant firm joins those plugging new take on strategy that’s struggled

Asia-Pacific banks revise conduct scorecards

DBS, Maybank and others tweak performance metrics to reward good behaviour over hard sales

BoE is going to curb Libor collateral. But how much?

Harshest of three ideas to shift market to Sonia would largely ban Libor collateral from its market ops

Banks to Fed: reshape CCAR for peacetime

But Quarles deflates mood: banks using their own models for capital is “not under active consideration”

Hong Kong seeks European equivalence for Hibor and Honia

For the territory’s crucial renminbi fixings, however, no path to approval has yet been decided

trueEX to shut swaps trading platform

Would-be disruptor will exit business on July 19, leaving swaps market in hands of incumbents

CCP margin buffers too big, research suggests

Procyclicality calculations should depend on expected spikes in volatility, argue Ice risk experts

Rival FXPBs scoop up former Citi clients

BNP Paribas, Deutsche Bank among those taking on clients axed by the US bank, plus others worried they’ll be next

Avoid floating rates on non-cleared repo – ICMA

€STR won’t be published until October, but its next-day publication will make settling complicated

UBS exec: first trades via USC could take place this year

Risk Live: utility settlement coin project backed by group of banks moving “incredibly fast”

Mifid transparency regime snares illiquid bonds

Banks and lobbyists call on EC to remove emerging market bonds from real-time transparency

Search engine study shows limits of alternative data

Google Trends adds nothing to volatility predictions, researchers find

Banks and prop shops expect more trading tie-ups

Risk Live: White-labelling a new battleground, with Barclays, BNP, Citadel and Jump touting price streams

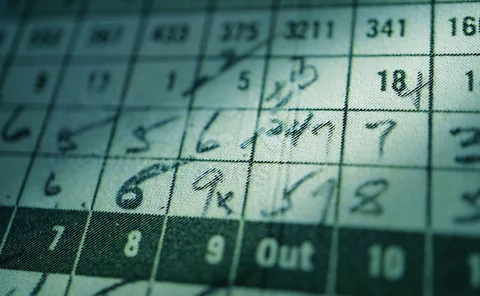

Ice, CME set to launch new VAR models in early 2020

Bourses plan to switch margining of energy futures at different times, prompting speculation of “arbitrage opportunities”

Podcast: Gregory and Chung on wrong-way risk modelling

Quants discuss a better way to model wrong-way risk

JP Morgan warming to derivatives-based term RFR rates

Risk Live: Unlike Libor, the market has a say in them. (Though they may not be real term rates, executive muses)