Risk management

All clear? Structural shifts add to repo madness

Many things contributed to 10% repo, among them a FICC programme and a surge in overnight funding

CCPs dismiss bank, buy-side criticisms

CME, Ice bat away suggestions of flaws in clearing house risk management

Deal misfires expose risk of contingent hedging

Banks hike premiums on deal contingent swaps amid Brexit uncertainty

CFTC refuses to budge on margin treatment of SMAs

Asset managers must agree new protocols for dealing with margin shortfalls in SMAs by September 2020

CLO investors find silver lining in Libor’s demise

A backward-looking SOFR rate will reduce the asset-liability mismatch that sank CLO equity in 2018

Post-Woodford, State Street has an idea on liquidity risk

You’ve heard of the liquidity coverage ratio. Try the ‘redemption coverage ratio’ for funds

In JP Morgan’s JV buy, some see snares of China

The US firm paid a ‘ransom’ for JV control. Others mull what that means for their own China strategy

A look under the hood of Span 2, CME’s new margin engine

VAR-based framework has new ways of netting contracts and setting volatility floors and more

Clients demand access to CCP default auctions

“In a default, we are comfortable taking on risk and can move quickly,” says DRW’s Wilson

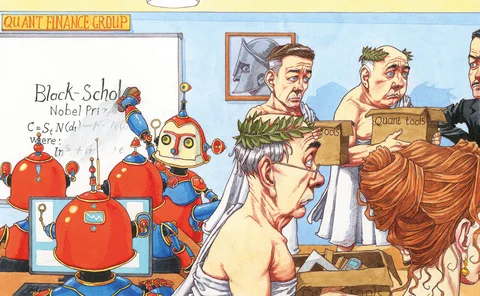

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

Can robots learn to manage risk?

Will machine learning transform risk management or give birth to a new breed of model risk? Probably both

How AI could tear up risk modelling canon

BlackRock, MSCI, LFIS among firms looking to replace traditional, linear risk models

Search engine study shows limits of alternative data

Google Trends adds nothing to volatility predictions, researchers find

Cleaning noisy data ‘almost 70%’ of machine learning labour

Quants flag signal-to-noise ratio as key to reducing overfitting risk

Podcast: Hans Buehler on deep hedging and harnessing data

Quant says a new machine learning technique could change the way banks hedge derivatives

A powder keg in forex: the prime broker business

Brokerages look at high-speed algo trading paired with bloated credit limits – and shudder

Fund ratings flip as 2008 losses fade from view

Over 90% of top-rated US equity funds have betas greater than one

Stick to core skills or risk data overload, says Goldman quant

Data-as-a-service chief says asset managers risk being swamped by new types of information

Volatility scaling unravels as market patterns shift

Waning power of quant approach could be a reason for trend following’s malaise

Fund houses get picky over where to use machine learning

Buy-siders limit usage of deep learning techniques due to haziness over their inner workings

Funds ring alarm on EU guidelines for liquidity stress-testing

Managers could be forced to use multiple methods to stress-test large number of funds every quarter

Robo traders not so different from us, says Man AHL risk chief

Watching over machine learning algorithms is similar to monitoring human portfolio managers

Buy-side quant says Brexit a ‘test’ of new AI

Natural language processing can give “more insight” into possible market shudders, says Simonian

Funds use artificial intelligence to weigh ethical investing

Quants explore links between ESG investment and outperformance