Markets

Fee fight: dealers take aim at brokerage costs

Old tensions have new edge as banks urge clients to bypass platforms

Index delays leave passive bond funds in purgatory

Moves to postpone index rebalancings could backfire as rating agencies press ahead with downgrades

Fed action fails to dampen spreads for riskier credits

Borrowing costs for some issuers are still two to three times the historical average

Dollar funding squeeze eases after March madness

Fed action helps restore equilibrium, leaving fears of quarter-end crunch unfounded

Libor webinar playback: spotlight on bonds

Panellists from Lloyds, RBC Capital Markets and TD Securities discuss efforts to switch to new lending benchmarks

Libor webinar playback: spotlight on loans

Panellists from McKinsey, the LSTA and UBS discuss efforts to switch lending to new benchmarks

Seeing red over blue-chip swap in Argentina’s NDF fiasco

Emta protocol salve aside, peso settlement rate snafu is a warning for emerging market FX derivatives

Equivalence failure threatens European share trading

UK and EU investors may be forced to trade dozens of shares on less liquid exchanges, analysis shows

In choppy forex markets, algos buck expectations

Goldman, Nomura and others report increased volumes, although some clients revert to principal quotes

US Treasury market holds its breath after high drama

Intermediation broke down after off-the-run bonds were dumped on banks

Spot FX could be dragged into Mifid II

EC tells Risk.net it is studying Australian-style approach to regulating currency trading

Bonds and swaps struggled in virus volatility

Low liquidity and wider spreads amplified by remote working, traders claim

‘Huge role’ for quants in Covid-19 response – MIT’s Lo

Policy-maker actions or missteps will drive markets, academic says

For FX dealers, virus brings volumes

Mixed feelings for sell-side traders as Covid-19 spurs wave of speculation and hedging

Alt data lends a different light to coronavirus impact

Smog, traffic data – even movie rentals – help analysts track economic effects of virus

Caveat pre-emptor: Man ESG chief talks snubbed markets

Robert Furdak is sparking discussions about responsible trend following in unsustainable stocks

FX aggregators flirt with scrutiny over brokerage charges

Making dealers pay for trades raises ‘payment for order flow’ questions

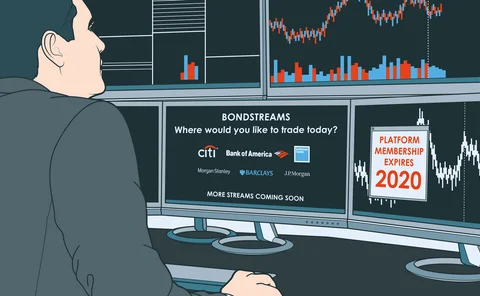

Full stream ahead for bonds

Price streaming offers cost savings and operational efficiencies, but it could fragment liquidity

Eurex members divided over liquidity risk charges

Banks say proposed charge too conservative, debate whether add-on should be charged directly to clients

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Regulators urge buy-side action on Libor shift

ARRC set to release ‘checklist’ for buy-side firms, while FCA assesses exposures

Bank disruptors: JP Morgan smashes silos

To foster innovation, the US banking giant rebuilds its culture by breaking boundaries

Trading venues decry disruptors as MTF battle heats up

Unregulated tech vendors accused of operating as de facto venues; a claim dismissed as “entirely outrageous”

Private equity investors see savings in AI

Unigestion, Schroders using machine learning to avoid ‘obvious losers’ among private equity firms