Derivatives

Margin exchange threshold relief: get out of jail free?

‘Game-changing’ IM exchange threshold relief may not be the phase five free pass it first appears

Regulators urge buy-side action on Libor shift

ARRC set to release ‘checklist’ for buy-side firms, while FCA assesses exposures

LCH targets hardwired pre-cessation triggers

Proposal aims to align transfer pricing for cleared and bilateral markets in the event of split on ‘zombie Libor’ triggers

Bank disruptors: Crédit Ag taps AI to lure swaptions business

Machine learning model predicts client demand with high accuracy, giving traders an edge in pricing

Aberdeen head of structured solutions departs

De Roeck considering Libor discontinuation consultancy launch

CFTC urged to cement relief from a non-cleared margin rule

Industry seeks permanent right to specify two minimum transfer amounts: for initial and variation margin

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

Asian investors primed to buy more CLOs, experts say

Liquidity and diversification are drivers for demand, after US loan market’s recovery from blip

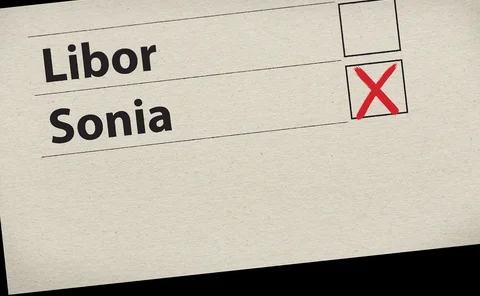

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

SEC derivatives rule may lead to new products

Proposed VAR limit is expected to benefit risk parity and defined outcome strategies

First Ibor versus SOFR cross-currency swap trades

Westpac and Citi strike BBSW/SOFR trade in landmark moment for Australian market

Volatility becalmed, trade in forex options plummets

With central banks in tandem on policy, market churn has lessened considerably, and trading as well

BMR rift fuels zombie Libor uncertainty

False rate could limp on for months under EU’s benchmark regulation

Stay ahead of the fixing lag

The price of fund-linked derivatives depends on the fixing lag of the underlying funds

Ice swap rate adds RFQ data; adopts Sonia

Industry backs overhaul of term swap rate to curb non-publication and hasten Libor switch

All clear? Structural shifts add to repo madness

Many things contributed to 10% repo, among them a FICC programme and a surge in overnight funding

LCH won’t back single fix for swaptions switch

Clearing house pledges to “support” multiple solutions to discounting problem

CFTC set to eliminate post-trade name give-up

Practice has been a mainstay of Sef trading but chairman Tarbert wants it gone

Frandt or foe? FCMs hit back at Esma buy-side clearing salvo

Esma pushes dealers to publish standardised fee schedules amid clearing capacity fears

Lloyds wins consent to flip £1bn covered bond to Sonia

The conversion, backed by 99.84% of bondholders, marks another milestone in the Libor transition

Deal misfires expose risk of contingent hedging

Banks hike premiums on deal contingent swaps amid Brexit uncertainty

Synthetic Libor mooted as ‘tough legacy’ fix

Recalibration of doomed rate or catch-all legislation under debate as lifeline for lingering contracts

Buy side seeks non-cleared margin relief for SMAs

Sifma AMG calls for $50 million IM exchange threshold to be set annually