Interview

Mizuho EU CRO reveals his top risks – they may surprise you

Fears over technology dominate Wolfgang Koehler’s list of greatest risks for Mizuho’s EU unit

Why central banks aren’t worried about FX algos – for now

Disclosure failings feed into FX code; other issues are worrying, but distant, says SNB’s Maechler

Back to school: BlackRock uses quant quake lessons on Covid

Pandemic prompts a switch in approach from strategic to tactical

Podcast: Investing, climate risk and energy firms

How are investors enabling the move to the low-carbon economy?

Why a top quant wants to be wrong about markets

Former Pimco quant Rebonato sees weak returns, inflation and sovereign debt troubles ahead

Podcast: the future of retail investment in oil

Will negative prices and big losses curb retail investors’ appetite for oil futures over the longer term?

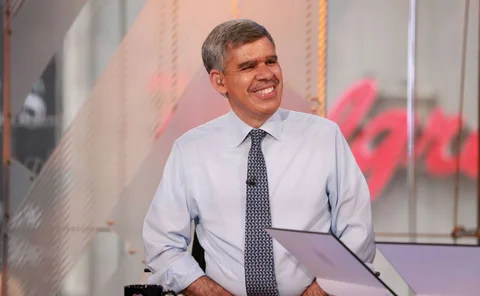

El-Erian on Covid-19 policy risks and central bank capture

Former Pimco chief says Fed has gone too far, market function rules needed and chance opens for shared policy load

Volume-starved SOFR leaves quant hankering for data

At T Rowe Price, a top quant is tired of SOFR being “yanked around by the liquidity premium”

Q&A: CFTC’s Behnam on tackling market risk in climate change

Commissioner wants to see new derivatives products to help mitigate climate threat

Video: Volatile energy prices will be the norm in 2020, says Phillips 66 risk manager

IMO 2020, volatility and shareholder activism will be major challenges next year, says Earl Burns

Video: BP Energy Company's CRO on data and the impact of new fundamentals

Profound changes in energy market fundamentals are making historical data less and less useful, says Gary Taylor

Q&A: Blockchain in commodities – a solution in search of a problem?

Competitors must work together if technology is to harness its potential, say three industry leaders

Tech marathon for FCA as Brexit uncertainty continues

FCA international head says regulator faces huge reporting and data sharing challenges

Q&A: Japan regulator aims to be glue for fragmented rules

“Unintended and unnecessary” splits in regulation damage financial markets, says FSA’s Ryozo Himino

Q&A: Japan RFR group head on term rates and Tonar liquidity

MUFG’s Matsuura discusses term benchmark options, cross-currency swaps and Tibor’s future

Q&A: CFTC’s Quintenz talks bitcoin, Nasdaq breach, algo trading

On cryptocurrencies, commissioner worries about spot market, but has confidence in big futures exchanges

Bridgewater co-CIO on risk parity, correlations and contagion

All Weather fund’s approach remains poorly understood, says Prince

Q&A: EU’s Hübner on Brexit and future of equivalence

Top EU lawmaker discusses improvements to equivalence, contract continuity and clearing relocation

Winton’s David Harding on turning away from trend following

Founder explains decision to scale back weighting of strategy that made firm’s name

Q&A: French regulator defends bank rules for prop traders

ACPR official wants to set asset threshold for full CRR application below current €30 billion

Denmark’s ATP warns of inflation threat to risk parity

Pension fund cuts risk to guard against correlation switchback

History suggests stock market crash not imminent – Goetzmann

Stock market bubbles have seldom burst, says Yale economist

Q&A: Giancarlo stresses importance of international relations

EU regulatory inexperience causes problems for CFTC chairman

Fed’s Powell on Libor reform, repo and clearing

Risk30: Market doesn’t need to “clear all US dollars in US and all euros in eurozone” says next Fed chair