Technology and data

Advances in technology and data are transforming every facet of the capital markets. From banks deploying sophisticated analytics to better model capital exposures, or leveraging cloud technology to scale stress-testing capabilities and build new risk applications. To asset managers sifting alternative data to gain competitive insight or using intelligent algorithms to activate trading strategies in milliseconds, Risk.net’s coverage explores the potential and limitations of new technologies such as AI, machine learning and blockchain, and the challenges for regulators in keeping pace with cutting-edge innovation.

This section features predominantly third-party content. Read more about our policy on this content here.

Raising the bar on real-time trade controls with next-gen tech

In an exclusive Risk.net panel session, convened in collaboration with Droit, experts discussed the evolving challenges and opportunities resulting from tighter regulations, and tips for building a future-proof real-time trade control framework

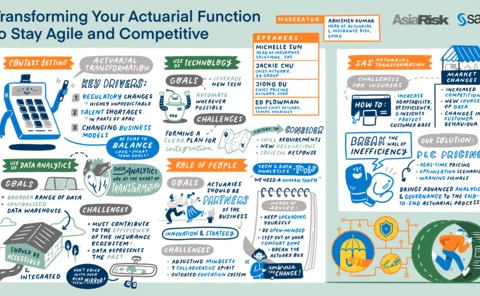

Transforming your actuarial function to stay agile and competitive

While transformation is important, its success depends on putting data in capable people’s hands

Decision science: from automation to optimisation

The full benefits of investing in a digital approach to credit decisioning are yet to be unleashed, despite advancements in automation and analytics at banks

Risk applications and the cloud: driving better value and performance from key risk management architecture

Today's financial services organisations are increasingly looking to move their financial risk management applications to the cloud. But, according to a recent survey by Risk.net and SS&C Algorithmics, many risk professionals believe there is room for…

Holistic credit risk assessment and the goal of safe unbiased modelling

In this Asia Risk webinar, experts in artificial intelligence (AI) and machine learning examined the growing applications being seen in the field and their merit in credit risk modelling

Faster than the speed of crime: how cloud-enabled fincrime strategies are helping firms fight back

The volume and complexity of financial crime has surged. In a webinar convened by Risk.net and sponsored by NICE Actimize, experts in this field explored five themes around safeguarding your institution and customers from fincrime with the speed and…

NIT protocol expanded among plans to electronify the full bond lifecycle

Sponsored podcast

How energy risk managers are responding to extreme volatility

Sponsored content

The future is now: how data science is revolutionising risk management and finance

This webinar explores how your organisation can move beyond legacy technology, better meet investor demands and remain competitive by embracing the future of finance.

Staying ahead of financial crime: powered by the cloud

A webinar exploring how to safeguard your institution and customers from financial crime with the speed and agility of the cloud

KWA Analytics spearheads CTRM modernisation drive

Sponsored content

The importance of enterprise resilience alongside rapid digital transformation

The Covid-19 pandemic has accelerated digital and organisational transformation for many companies but, as leaders across industries note, this has also made them more vulnerable to new risks. In this feature, ServiceNow explores why further change is…

The importance of preparation and technology in a world of risk

This webinar explores the implementation of smart technologies to transform risk management strategies and improve risk teams’ credibility within and influence on the wider business

Fraud and compliance 2.0: wising up to next-generation technology and boosting payment fraud detection

Fraud can take place due to checks occurring too late in the payment process, after the payer believes the payment has been confirmed. This webinar explores how simplifying the payment process by connecting compliance directly at the point of payment…

Shaping the future of risk and finance with analytics and integrated technology

This webinar explores how to enhance business planning activities, while accelerating regulatory demands with limited resources amid a need to derive greater value from the analytic lifecycle

The relentless rise of real-time data

Rob Lane, head of real-time feeds at Refinitiv, discusses the changing data needs of banks and buy-side firms and how the cloud is helping improve access to a key source of competitive advantage

Digital transformation and the future of GRC

This Risk.net survey report explores the impact of digitalisation on financial firms, and the changing strategies, resources and technology deployed by the governance, risk and compliance function

Leveraging a hybrid cloud for better decision‑making

At a Risk.net webinar in association with open-source solutions provider Red Hat and analytics services provider SAS, panellists discussed how financial institutions can leverage the hybrid cloud to analyse data, reach trustworthy decisions and maximise…

Moving targets: the new rules of conduct risk

How are capital markets firms adapting their approaches to monitoring and managing conduct risk following the Covid‑19 pandemic? In a Risk.net webinar in association with NICE Actimize, the panel discusses changing regulatory requirements, the essentials…

Four assurance mega-trends shaping risk management

For business leaders, the idea of a world changed forever is giving way to a new reality – a world forever changing. As Paul Butcher, chief executive officer at LRQA, explains, the implications for risk management are dramatic and, as a result,…

Leveraging liquidity scores and pricing data in portfolio trading

In this podcast, Zoi Fletcher, associate commercial editor, Risk.net, talks to Matt Walters, head of product, portfolio trading at MarketAxess, about how data analytics is improving outcomes in portfolio trading, the optimal situations in which it should…

Climate risk takes scenario analysis and stress-testing to the next level

Financial institutions are facing several challenges as they prepare for the transition risk journey that will see them evaluating their existing risk and finance solutions. Ludwig Dickens, client advisor, risk business consulting, at SAS discusses what…

Data analytics set to fuel change in the oil market

Privileged data insight is no longer the sole preserve of the world’s oil conglomerates. Access to insightful analytics is providing a new competitive edge for smaller and mid-sized commercial and trading firms in the oil market, helping them navigate…

The FRTB challenge: banks brace for further uncertainty

The widely anticipated implementation of the Fundamental Review of the Trading Book (FRTB) hit another obstacle when the Basel Committee on Banking Supervision pushed back the roll-out by another year to January 2023. With different jurisdictions…