Clearing

Asia Risk Congress: Clarity needed on close-out netting

Panellists at Asia Risk Congress say there needs to be clarity on close-out netting in certain countries before establishing CCPs

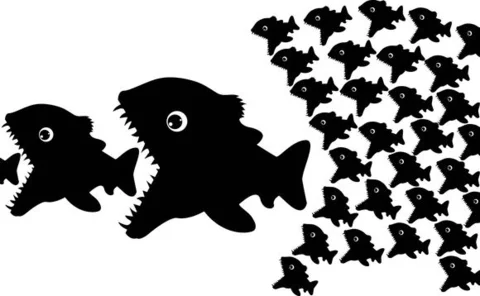

IMF: CCP structure increases systemic risk

The likely increase in the number of central counterparties will create more 'pockets of risk', says senior economist

Rule changes make it harder for small firms to use CCPs - Risk.net poll

Esma's decision to make indirect clearing an optional service could leave smaller firms without clearing access, according to a poll of Risk.net readers

Korea to miss OTC clearing deadline

It is ‘highly unlikely’ that Korea will meet the deadline to start clearing OTC derivatives by January 1, 2013 due to legislative delays, according to market participants

JSCC reviews capital threshold for clearing membership

Japan’s central counterparty proposes a 20-fold lower capital threshold for membership for it to qualify as a recognised clearing house under US rules; it also started successfully clearing yen interest rate swaps as of last week

CCIL trade repository reporting to extend to all currencies

After the initial launch in July, CCIL moves to phase two in its trade repository build-out

CFTC’s clearing timeline prompts backloading "meltdown"

A re-reading of the CFTC's phase-in rules for central clearing is prompting alarm among buy- and sell-side firms

Indirect clearing: The capital conundrum

Draft European Securities and Markets Authority rules on indirect clearing caused uproar when they appeared in June. The regulator removed the most controversial elements in its final text, but dealers are still in the dark about the capital treatment…

Standard docs may not prevent clearing contract crunch

Preventing a clearing contract crunch

Client clearing: Soaring volumes disguise scary workload

Not clear yet

SGX proposes to drop clearing member minimum share capital from S$1bn to S$50m

First Asian exchange to offer client clearing looking to dramatically alter the terms to become an OTC client clearing member

Final Esma clearing rules too rigid, CCPs say

Regulator has not given clearing houses enough freedom to calculate margin requirements, critics say - and Europe's CCPs may have to charge more for futures than their US rivals

Ice move from swaps to futures unlikely to be last, says O’Malia

The decision by Ice to speed up the transition of its cleared OTC energy contracts to futures reflects regulatory uncertainty, and is likely to be replicated by other exchanges, says CFTC commissioner

Indirect clearing to be overhauled in final Esma rules

Indirect clearing will not be compulsory, sources say – and a controversial 30-day guarantee for indirect clients will also be removed

OTC Derivatives Clearing Summit: Some FCMs charging five times more than others, says panel

Fees charged by clearing members can vary wildly – and low-cost providers may try to terminate relationships if they prove unprofitable, panellists warn

OTC Derivatives Clearing Summit: Joint solution needed on intraday margin calls, says panel

Dealers, clients and clearing houses need to work together to resolve problems caused by intraday margin calls, say panellists

OTC Derivatives Clearing Summit: Industry will struggle to meet clearing deadlines

Buy-side firms will struggle to finish legal and operational work ahead of US mandated clearing deadlines – and they are not the only ones, says panel

Unclear on clearing in Germany

Unclear on clearing

What will clearing cost?

What will clearing cost?

Eurex looking to clear OTC derivatives from Asian clients within 12 months

Eurex is latest clearing house to enter Asian market

Industry slams 'unworkable' Esma proposals on indirect clearing

Clearing members would be forced to guarantee trades executed by their clients' clients - on terms the member firms have not agreed

LCH.Clearnet model ‘not appropriate’ for Australian market, say two domestic banks

Two Australian banks speaking at Risk & Return Australia are critical of LCH.Clearnet for not meeting local market needs with its central clearing operation

LCH readies launch of new NDF pairs and client clearing

Five months after launch, ForexClear is ready to start offering client clearing and to add five new currencies to the service, pending the approval of the FSA and the CFTC