GARP

As interest rates surge, bankers fret over last year’s models

IRRBB modellers trying to predict client behaviour have little relevant data to fall back on

Pension funds face intraday margin calls from anxious clearers

Some banks stick with T+1 margin posting, but others balk at funding cost and counterparty risk

Gamma zero: an overlooked signal of volatility is flashing red

Markets are most erratic when option hedging exposures are flat

Margin for non-cleared European energy trades to jump 80%

Annual recalibration of Simm could catapult some energy firms over relief thresholds

Gilt volatility to live on in IM and capital models

Even if sterling rates vol subsides, it will impact interest rate and cross-currency swap costs for years

Brokers slam CME over ‘conflict of interest’ in FCM plan

Clearing members question how CME could be quasi-regulator as well as direct competitor

‘Perfect’ VKO trades knock the smile off vol

Dealer hedging of options which profit from ‘spot down, vol down’ may have amplified rare dynamic

How requests for quotes could amount to ‘insider information’

Lawyers say Esma’s incoming pre-hedging guidance could make firms liable for multimillion-euro fines

SA-CCR’s sacrifice: who stands to lose from new capital rules

Risk.net research shows the potential for dealers to be left at a disadvantage to their foreign rivals

Pension funds brace for end of BoE intervention

Funds boost collateral buffers by as much as 300bp, as October 14 deadline looms

Interest rate scenarios: skinny-dipping with the Fed

As US rates march upwards, Risk.net readers offer deeply diverging forecasts on the impact for markets through to 2024

CVA exposures to UK corporates jump ‘hundreds of millions’

Dash for credit protection triggered a doom loop in the CDSs of cross-currency swap counterparties

Keep risk parity simple, stupid

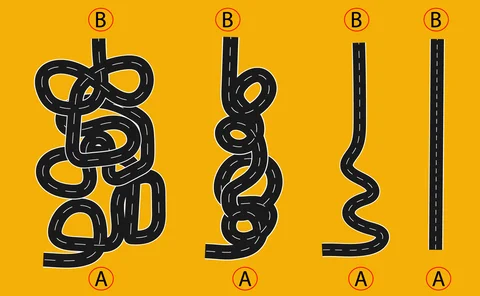

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

Talking Heads 2022: Rates market ruckus

Inaugural interview series looks at how sell-side traders are adapting to a world of surging inflation and rates

UK pensions hit with £100m margin calls as gilts and sterling slide

At least three LDI managers request emergency capital as others consider unwinds to avoid default

Don’t fear the repack: why banks will retain inflation swaps role

Counterparties’ increasing use of direct trades does not spell end of intermediation

SOFR swap basis could pose ‘systemic risk’

Trading curbs must be loosened to prevent tripling of unhedgeable basis risk, says senior banker

FX hedging dilemma vexes corporates as costs spiral

High volatility jacks up option prices, forcing firms to reconsider hedging activities

BoE’s planned procyclical capital hike bewilders banks

Some doubt regulator will go through with buffer hike while forecasting recession

Could a cold collateral winter be coming for pension plans?

UK LDIs passed an early test from rising rates, but margin call pressure is mounting

EU Parliament creates multiverse of SA-CCR outcomes

Some MEPs want to ease rules further than EC draft; others want return to undiluted Basel text

Credit checks, what credit checks? How crypto lending ate itself

Collapse of hedge fund Three Arrows Capital exposes “sloppy and irresponsible” credit standards among crypto lenders

Barclays confronts ‘implausible’ macro risks

Talking Heads 2022: Bank is reaping rewards of sticking with its trading businesses, says macro head Lublinsky

Banks shock commodities by 1,000% in stress-test rethink

Energy price spikes force clearing firms to consider extreme or even ‘implausible’ scenarios