Samuel Wilkes

Samuel Wilkes is the deputy editor of Risk.net’s regulation desk, based in London. Sam graduated from the University of Hull with a bachelor’s degree in history.

Follow Samuel

Articles by Samuel Wilkes

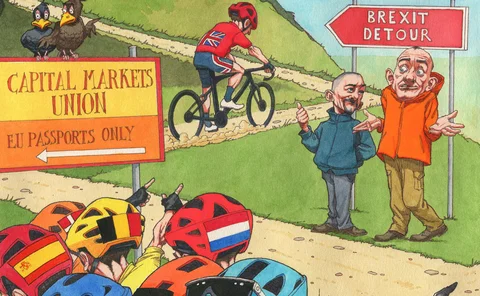

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

New Mifid equivalence rules leave UK firms in limbo

Revised market access rules won’t kick in until six months after UK leaves single market

PRA’s Woods: ending capital deductions for IT is ‘dubious’

Regulator signals potential divergence between UK and EU capital rules after Brexit transition

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Worth the cost? EU rethinks Mifid disclosure rules

Banks would gladly be rid of cost disclosures, but some clients want them improved, not scrapped

EU council dials back on margin haircuts for CCP resolution

Lawmakers close avenues for regulators to dip into non-defaulting members’ initial margin

Mifid’s free data mirage vexes markets

Users struggle to access post-trade data despite European regulator’s push for transparency

EU snubs plan to delay CCP open access rules, for now

Attempt to squeeze delay into crowdfunding rules fails, but Mifid review provides last chance

Leaked email reveals new assault on CCP open access rules

Largest group in European Parliament wants to shoehorn delay into crowdfunding legislation

EU gives one-year margin reprieve on equity options

Regulators point to possible systemic risk in margin loophole, as industry urges parity with US

Germany scrambles to shut the door on Mifid open access

Finance ministry will face fine timing to reverse clearing rule during its EU presidency

Why Europe’s markets might need Mifid III

Lawmakers leaning towards small-scale review, others call for fuller rewrite

EU to grant last-minute margin reprieve for equity options

European Commission to publish changes to Emir technical standards within days

EBA’s Campa: reduce Pillar 2 charges to offset output floor

Bankers plead for smaller capital hit and more predictability on implementation of Basel III

Structural snags frustrate STS for synthetics

Curbs on excess spread and collateral stymie route to ‘high-quality’ signifier

Double trouble: don’t blur FRTB deadlines, warns ECB

Ignoring reporting model deadline could muddy capital approval cut-off

Capital cut for synthetic securitisations splits regulators

European rulemakers wary of diverging from Basel standards

EU banks grapple with NMRF proposals for volatility models

EBA options for lighter capital treatment of parametric curves could prove impractical

European FRTB proposals spark XVA overload fears

Banks warn of overly complex revaluation process and heightened risk of backtest fails

EU seeks to offer reassurance on Brexit clearing exemption

Commission can act quickly to stave off no-deal market disruption, insists official

Watchdogs ask EC to delay repo haircut floors. Will it?

EBA says hedge funds will skirt the rules, but Basel and FSB want haircut minimums in place

FCA chief calls for EU to extend Brexit clearing exemption

Bailey also urges EU to grant equivalence determinations for UK trading venues

Industry expects US FRTB proposals by year-end

Fed likely to co-ordinate progress with EU, which may also accelerate its timetable

Enria: no reason for EU to deviate from Basel output floor

ECB supervision chief urges lawmakers to implement contentious Basel III model constraints