Peter Madigan

Follow Peter

Articles by Peter Madigan

JP Morgan slashes commodity desks

Fate of other prop desks unclear ahead of enactment of Volcker Rule

Updated Isda CDS novation process to boost efficiency while minimising risk

Revised rules replace laborious consent-then-confirm novation process

New MSRB rules seek to end municipal swap adviser scandals

Dodd-Frank rules take aim at brokers pushing rate swaps for bigger commissions

OTS pays the price of failure

The US Office of Thrift Supervision will be abolished under the Dodd-Frank Act, but is the agency being made a scapegoat for the financial crisis or will its dissolution help mitigate regulatory arbitrage and raise supervisory standards? Peter Madigan…

Passage of Dodd-Frank Act heralds start of rule-making process

Financial reform legislation passes in the US Senate, as focus turns to the complex issue of implementation

Dodd-Frank: Abolition of OTS will boost OCC

OTS and OCC light-touch supervision grew bank assessment fees but fed institutional collapses

US regulatory reform reaches tipping point

It's not quite over yet, but the text of the Dodd-Frank bill has been agreed and derivatives users have cause for both celebration and concern.

Are the CFTC, SEC and Fed equipped for their new powers?

Despite a last-minute hitch, the final text of ambitious financial regulatory reform legislation was agreed last month, which would hand supervisors sweeping new powers over financial institutions. But are regulators equipped for their new…

Energy companies face up to clearing requirements

Elimination of a catch-all clearing exemption in US financial reform legislation looks like bad news for big energy companies – the industry warns mandatory derivatives clearing will do untold harm. Peter Madigan reports

Dodd-Frank: forex swap clearing exemption at Treasury secretary’s discretion

Blanket forex exemption dropped from final bill; Treasury to determine issue

Little progress on US regulatory reform as conference ends first week

Heated debate and vote interruptions slow the reconciliation process

US regulatory reform legislation nears 2,000 pages as conference begins

Democrats and Republicans spar in the first meeting of the two-week process.

Isda credit auction sets 20% Ambac recovery rate

Protection sellers on monoline face 80% cash value payout

When market and credit risk collide

The financial crisis highlighted that interactions between market risk and credit risk could expose banks to greater risks than had been assumed. Banks are responding by altering their structure and the models they use – but it is by no means an easy…

Spotlight on Goldman

The US Securities and Exchange Commission filed a lawsuit against Goldman Sachs in April, alleging it had misled clients by not disclosing that a major hedge fund had helped select the underlying assets in a collateralised debt obligation and was…

Brazil leads booming sovereign CDS trade

Sovereign CDS transactions eclipsed corporate protection volume in past nine months.

Goldman CDO suit throws focus on collateral manager conflicts

Goldman Sachs fraud allegations show portfolio managers credit selection interests are often not aligned with benefiting CDO note-holders, say lawyers.

FDIC calls on bank subsidiaries to submit resolution plans

Deposit insurer targets affiliates of $100bn holding companies

Structured Products Americas: More mis-selling fines to follow, Finra warns

The US industry's own regulator says its mis-selling investigation may lead to more fines for US companies.

Structured Products Americas: Lat-Am structured products "set for boom"

The European debt crisis is making Latin America look relatively attractive, one regional trader says.

Senate bill raises the stakes in financial reform debate

The future of the derivatives market in the US has become the subject of a political tug-of-war, after the Senate Committee on Agriculture, Nutrition and Forestry passed a bill prohibiting federal support to all dealers, derivatives exchanges, clearers…

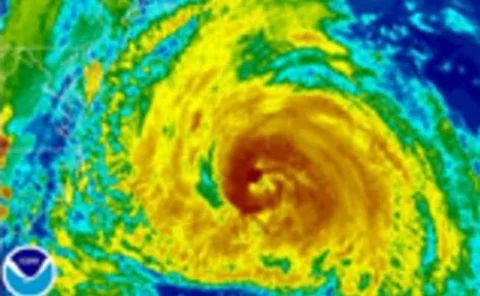

Cat bonds return

The market for catastrophe bonds dried up in 2008 and early 2009 as the financial crisis took its toll. Confidence is returning, helped by wide spreads and a re-think about the assets used to collateralise catastrophe bonds, but issuance has yet to…