Natasha Rega-Jones

Follow Natasha

Articles by Natasha Rega-Jones

Why the numbers don’t add up for post-Libor hedge accounting

Experts raise concerns over IASB’s Phase II plans to move on from Libor

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

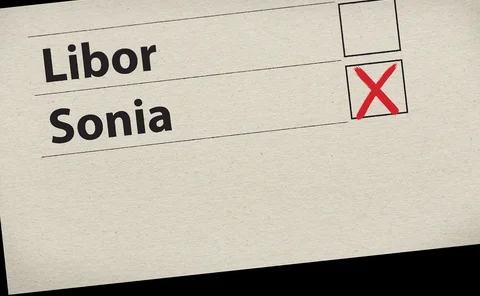

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

In the US, it’s an even ‘tougher legacy’ for Libor

A legislative solution for cash products is in the works, but lawyers say it raises constitutional issues

Euribor fallbacks could hit thin legal ice

In Italy and Germany, compound interest – the foundation of Euribor fallbacks – is actually illegal

Buy side still not adopting global forex code – Debelle

Forex committee wants asset managers to embrace standards; shifts focus to algo trading

People moves: new global co-heads at Citi, Tran takes Asia-Pacific role at Crédit Agricole, RBC Capital Markets hires in sales, and more

Latest job changes across the industry

PRA drops ‘timely’ payouts in credit risk insurance

Plan for expeditious timeframe set aside to delight of banks worried about retaining capital breaks

Deal misfires expose risk of contingent hedging

Banks hike premiums on deal contingent swaps amid Brexit uncertainty

Ice swap rate failure disrupts exotics desks

Dollar version of rate wasn’t published on nine out of 22 working days in August

Isda set to launch fallback spread consultation

Lookback and mean/median study to launch this month, with results tipped to move the basis market

LCH sets €STR swap clearing launch date

Clearing house to offer the swaps from October 21, discounted at Eonia

Brexit flips LCH-Eurex basis

LCH-Eurex basis has inverted on buy-side flows, hitting –1.3bp at July low

Libor switch spells trouble for loan systems

Lenders face costly updates to ageing legacy platforms to cope with new risk-free rates

ING issues ESG-linked interest rate swap

Dutch bank takes carrot-and-stick approach on interest rate swap for oil and gas equipment firm

People moves: Ritchie steps down at Deutsche; Lynch takes Emea role at TP Icap, and more

Latest job changes across the industry

How the top 50 dealers tackle forex last look

Uneven disclosure practices are making life difficult for agency algos and ECN trading

Six big forex market-makers call for end to last look

Citadel Securities, Jump and Virtu among those repudiating controversial practice

Forex ‘last look’: how non-banks stack up

Research shows patchy disclosures, plus differences from banks on pre-hedging and rejected orders

Resented elsewhere, Mifid finds love at Esma

Huge cache of data helped Esma spot market abuse and inform policy, head of market data policy says

Dealers issue rallying cry for cross-currency benchmark reform

Risk Live: Global banks need to drive new standards for multi-rate swaps, say leading industry execs

FCA: Sonia derivatives liquid enough to create term rates

Andrew Bailey says a forward-looking rate can work, but its use should be limited

Sonia advances: liquidity builds as banks eye interdealer shift

Libor’s successor has some solid footholds. Wider acceptance could come as soon as later this year

BNPP’s English court win calms ‘jurisdiction shopping’ fears

Unanimous decision reaffirms importance of English law provisions in derivatives contracts, say lawyers