Helen Bartholomew

London bureau chief

Helen Bartholomew is London bureau chief for Risk.net.

She has written on a range of derivatives and markets topics including benchmark reform, margin rules, equity derivatives and structured products. Prior to joining Risk.net, she was derivatives editor for International Financing Review, part of Thomson Reuters, where she previously reported on debt and equity capital markets.

Helen holds a bachelor’s degree in anthropology from the University of Durham, UK.

Contact Helen on +44 (0) 20 7316 9223 or helen.bartholomew@infopro-digital.com

Follow Helen

Articles by Helen Bartholomew

Euro RFR group calls for statutory Eonia fix

Legal designation for €STR as replacement rate would avert “confusion” in €9trn of legacy contracts

New Isda definitions pave way for bespoke swaps clearing

Pick-and-mix grid of floating rate options will make it easier to clear post-Libor bond hedges

A BMR-shaped hole in the US Libor transition

US could benefit from copying EU Benchmarks Regulation as market moves to shaky Libor successors

Confusion reigns as US prepares for Libor’s end

Mixed messages from US regulators make it more difficult to plan for life after Libor

Pick a rate: pitfalls and prizes in the post-Libor world

SOFR set to win big in replacing Libor, but trillions could scatter across alternatives

Time to end debate on SOFR alternatives, participants warn

Doubt over future of five credit-sensitive Libor replacements may be hindering late-stage Libor transition

Ice pips Refinitiv to synthetic Libor prize

FCA selects IBA term Sonia for sterling tough legacy fix; Torf chosen for three yen settings

SOFR alternatives remain on track despite regulatory warnings

Pointed criticism from FSOC has done little to dampen interest in credit-sensitive rates

SEC’s Gensler takes aim at Bloomberg’s BSBY index

Credit sensitive SOFR alternative has “many of the same flaws as Libor”, regulator says

The Libor replacement stakes: runners and riders

Credit-sensitive rates Ameribor and BSBY nose ahead of Ice, Markit and AXI; regulators keep watchful eye

Dealers back ‘SOFR first’ in bid to jump-start new rate adoption

Term SOFR recommendation would follow “in days, not weeks” of US swaps quoting convention switch

ARRC eyes July ‘SOFR first’ switch

Adoption of RFR for swaps quoting conventions should pave the way for term SOFR endorsement

Markit launches credit-sensitive SOFR alternatives

Crits can be used as add-on to SOFR, while Critr will be a standalone benchmark

BoE’s post-Libor clearing plan leaves yen swaps in limbo

Sonia and €STR will be mandated for clearing, while Tonar must wait until liquidity settles

CDS market prepares to join Libor transition

Ice and LCH will switch to new rates for margin interest; Isda to follow in standard model update

CME wins term SOFR race

Fed-backed working group puts term rate back on track, but low volumes keep endorsement on hold

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

Delays to IM model approvals causing ‘anxiety’ for MetLife

Isda AGM: US insurer says regulators unprepared to accept docs where model approval is obligatory

Accurate RFR hedges face liquidity trade-off, participants say

Isda AGM: Aligning swaps with assorted cash market conventions requires users to weigh liquidity cost

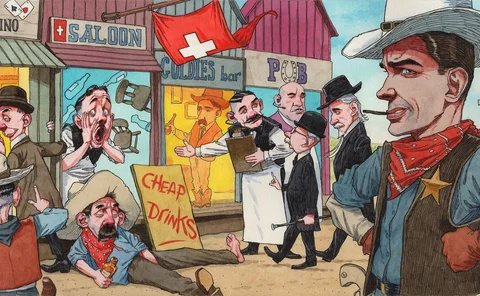

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Citi turns to decrement indexes for single-stock autocalls

US bank claims new Stoxx indexes for 23 single names will slash hedging costs and boost coupons

CME unveils term SOFR in face of ARRC doubts

Exchange group says benchmark aligns with ARRC principles – but committee has pushed back endorsement plans

FCA could get legal with USD Libor laggards

Incoming powers permit regulator to ban use of benchmarks with known cessation dates – but only for UK-supervised firms

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps