Catastrophe

Catastrophe bonds hit by Japanese quake

Investors ponder short- and medium-term effects earthquake could have on cat bond market

Cat risk – Solvency II standard formula is up to double industry view of nat cat risk

Standard formula is up to double industry view of nat cat risk

Cat bonds set to become new face of structured credit, say Axa chiefs

Two senior heads at Axa Investment Managers anticipate escalating demand for catastrophe bonds.

Profile: Swiss Re's Raj Singh

Predicitng the unthinkable

New hope for insurance-linked securities

Since the financial crisis the insurance-linked securities market has been squeezed into a tight corridor of issuance with only natural catastrophe bonds seeing any traction – a blow for a market that pre-2008 appeared to be on the cusp of developing…

Cat bonds return

The market for catastrophe bonds dried up in 2008 and early 2009 as the financial crisis took its toll. Confidence is returning, helped by wide spreads and a re-think about the assets used to collateralise catastrophe bonds, but issuance has yet to…

Predicting the unthinkable

Raj Singh, chief risk officer at Swiss Re, talks to Alexander Campbell

Cutting credit

Catastrophe Bonds

Point Carbon launches US power trading product

Point Carbon, an energy and environmental market analyst, has launched its first power trading analytics tool for the North American market.

CME acquires hurricane index

CME Group has acquired the Carvill Hurricane Index from Carvill America Inc. and renamed it the CME Hurricane Index.

Die Lehren aus der Katastrophe

Katastrophenrisiko

Taming nature with models

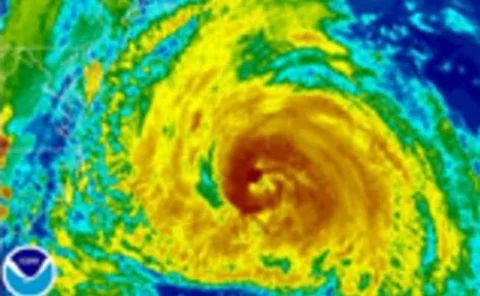

Catastrophe risk

Lessons from disaster

Catastrophe Risk

Taming nature with models

Catastrophe risk

Staying out of harm's way

Catastrophe Bonds

A stochastic step forward

Technology

Show me the money

Default Modelling

'Boom cycle' for US power prices

With input costs surging and demand growth currently outpacing supply additions in the US power market, analysts are expecting the space to tighten further. David Watkins reports

Cat bonds find their calling

Catastrophe bonds

The business of saying no

Rising energy prices have caused an upturn in demand response - or energy curtailment - in the last two years. Elisa Wood looks at how this is impacting power markets

The future arrives for renewables

The emerging market in renewable energy futures is expected to lower the cost of financing renewables and smooth out the volatility often encountered when running intermittent renewable resources, such as wind and solar. Catherine Lacoursière investigates

At a turning point

Catastrophe Bonds