Insurance

Profile: Swiss Re's Raj Singh

Predicitng the unthinkable

A long life for longevity swaps?

The market for longevity swaps is picking up pace, with several transactions completed over the past few months. But is this asset class here to stay or is it a response to market conditions? By Alexander Campbell

Hedge fund investment back on pension funds' horizons

Pension schemes are again making allocations into hedge funds, despite the negative performance from many funds – and therefore correlation with underlying markets – throughout the financial crisis. So why the interest? John Ferry reports

Variable annuity redesign led by US innovation

Variable annuity providers were hurt by basis risk, extreme volatility and policyholder lapses during the crisis, and guarantees were scaled back and repriced as a result. Now risk management is driving a US-led surge of innovation. Laurie Carver reports

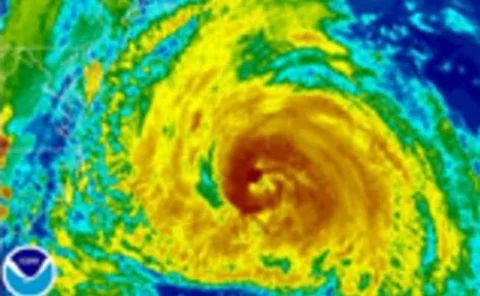

New hope for insurance-linked securities

Since the financial crisis the insurance-linked securities market has been squeezed into a tight corridor of issuance with only natural catastrophe bonds seeing any traction – a blow for a market that pre-2008 appeared to be on the cusp of developing…

Bond ambition – The World Bank’s attempts to launch a longevity bond in Chile

Attempts to diversify longevity risk into the broader financial system have so far focused on using swaps. But in an ambitious move, the World Bank has tried to launch the first ever longevity bond in Chile. Aaron Woolner reports on how successful this…

Reversal of fortune

Inverted swap spreads have defied earlier predictions that they were a short-term aberration to still be a feature 18 months after their first appearance. Is this set to continue and, if so, does it pose an opportunity for pension schemes and insurers?…

Portuguese insurers shielded from sovereign risk, claims regulator

A focus on high-grade corporate bonds in their investment portfolios is insulating Portuguese life insurers from the continued market pressure on the country's sovereign debt, according to Instituto de Seguros de Portugal (ISP), the country's insurance…

Cat bonds return

The market for catastrophe bonds dried up in 2008 and early 2009 as the financial crisis took its toll. Confidence is returning, helped by wide spreads and a re-think about the assets used to collateralise catastrophe bonds, but issuance has yet to…

Mature pension funds will not survive another financial crisis

Pension schemes have been severely affected by the recent financial crisis. But, according to Cardano’s Theo Kocken and Joeri Potters, the prognosis for recovery is dependent on the maturity of the individual schemes – unless there is widespread systemic…

Solvency management provides reinsurance opportunity

Testing economic conditions have prompted widespread moves by life insurers to reinsure their liabilities in order to gain capital relief. As the situation eases, will demand for reinsurance fall, or are other factors coming to prominence? Blake Evans…