Technical paper/Principal component analysis (PCA)

Auto-encoding term-structure models

An arbitrage-free low-dimensionality interest rate model is presented

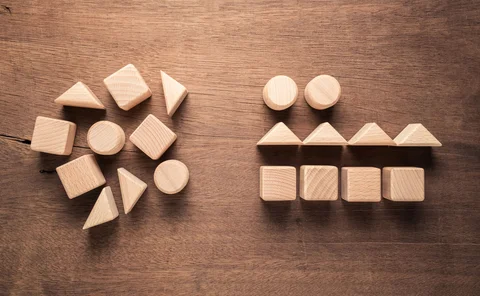

Axes that matter: PCA with a difference

Differential PCA is introduced to reduce the dimensionality in derivative pricing problems

A FAVAR modeling approach to credit risk stress testing and its application to the Hong Kong banking industry

In this paper, a credit risk stress testing model based on the factor-augmented vector autoregressive (FAVAR) approach is proposed to project credit risk loss under stressed scenarios.

Eigenportfolios of US equities for the exponential correlation model

In this paper, the eigendecomposition of a Toeplitz matrix populated by an exponential function in order to model empirical correlations of US equity returns is investigated.

Curve dynamics with artificial neural networks

Artificial neural networks can replace PCA for yield curves analysis

Flylets and invariant risk metrics

Kharen Musaelian, Santhanam Nagarajan and Dario Villani show how to build robust risk metrics for bond returns

Stock selection with principal component analysis

The authors of this paper propose a stock selection method based on a variable selection method used with PCA in multivariate statistics.

Risk budgeting and diversification based on optimised uncorrelated factors

Meucci, Santangelo and Deguest introduce a risk decomposition method based on minimum-torsion bets