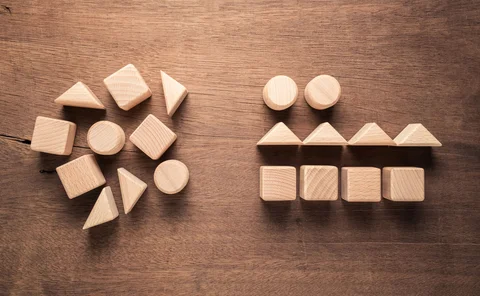

Portfolio construction

Best user interface innovation: J.P. Morgan

J.P. Morgan wins Best user interface innovation thanks to its Beta One portfolio solution

Man Group airs climate allocation tool for real-world decarbonisation

Compass is a guide for steering $200 trillion investment toward decarbonising high-emission industries

Optimal allocation to cryptocurrencies in diversified portfolios

Asset allocation methods assign positive weights to cryptos in diversified portfolios

Podcast: Artur Sepp on rates volatility and decentralised finance

Quant says high volatility requires pricing and risk management models to be revisited

Podcast: Jan Rosenzweig on fat tails and LDI portfolios

An optimised portfolio can look very different when extreme moves are given more weight

How Man Numeric found SVB red flags in credit data

Network analysis helps quant shop spot concentration and contagion risks

BNP Paribas quants ‘industrialise’ portfolio construction

Firm says tech, five years in development, takes two hours to do jobs that previously took two days

The private markets dilemma faced by asset owners

Demand for private markets has seen continued growth. Shar Kassam, vice-president at Nasdaq, and head of Nasdaq Asset Owner Solutions, explores why market volatility has led to additional considerations for portfolio construction, cashflow and liquidity…

A factor-based risk model for multifactor investment strategies

This paper presents a novel, practical approach to risk management for multifactor equity investment strategies.

Is factor momentum greater than stock momentum?

Is factor momentum greater than stock momentum? Yes – this paper argues – but only at short lags.

Fat-tailed factors

Independent component analysis is proposed as an alternative to principal component analysis

Performance attribution for multifactorial equity portfolios

This paper revisits the cross-sectional approach to the performance analysis of multifactor investment strategies.

Inflation scenarios: tail risks loom for US equities

Portfolios could lose more than one-third of their value if inflation stays high, suggests crowdsourced scenario exercise

A quant’s view on protecting stock-pickers from themselves

Ex-Citadel, Millennium risk manager says fundamental investors have much still to improve

Uncertain risk parity

This paper treats covariance as uncertain in order to find a risk parity weighting that does not count on perfectly optimized hedges and is robust to changes in regime.

Bonds fall from favour as shock absorbers for equity losses

Ultra-low rates force investors to rethink role of fixed income as diversifier

Time to move on from mean-variance diversification

A new diversification measure appears to produce better results than mean-variance optimisation

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

Optimal weights and hedge ratio behavior in Brent oil and Islamic Gulf stock markets

This paper examines the dynamics and spillover behavior between time-varying optimal weights and hedge ratios in order to analyze optimal volatility allocation spillover and characteristic structure.

Global investing under water? – Climate change could leave equities exposed

As impending global changes brought about by climate change loom, one issue in particular threatens to cause massive losses to institutional investors – rising sea levels. David Lunsford and Boris Prahl, of MSCI, explore where, despite the efforts of…

A sea change – Driving awareness to confront climate risk

Amid a global push towards green policies, the reality of overhauling how industries worth trillions of dollars operate is causing concern. A forum of market participants and sponsors of this report discuss the levels of awareness of climate risk and its…