P2P lending

Did fintech loans default more during the Covid-19 pandemic? Were fintech firms “cream-skimming” the best borrowers?

The authors propose a model which can be used to identify the "invisible prime" consumers from the nonprime pool for fintech loans.

Small and medium-sized enterprises that borrow from "alternative" lenders in the United Kingdom: who are they?

This study provides a general overview of the external financing landscape for the UK SMEs and an exploratory analysis of the SME portfolio of one of the alternative lenders in the United Kingdom.

Community energy retail tariffs in Singapore: opportunities for peer-to-peer and time-of-use versus vertically integrated tariffs

In this paper, an electricity market is simulated using an iterative double-auction algorithm that resolves a social welfare optimization problem based on the Kelly auction mechanism. It is adapted to the case of Singapore.

Evaluating the risk performance of online peer-to-peer lending platforms in China

The objective of this paper is to select effective risk indicators and thus establish a risk index system of P2P platforms so as to evaluate the risk performance of these platforms in China.

Spike in bad loans raises scrutiny of P2P credit models

Jump in delinquencies at some lenders prompts questions over modelling practices, but firms stand by their approach

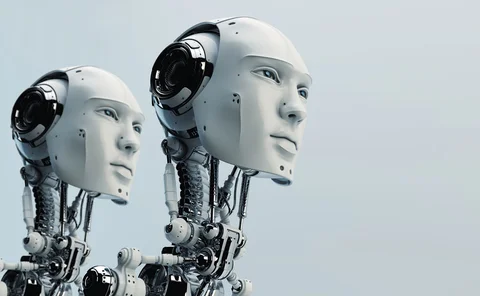

Rise of the machines: AI begins to tackle credit risk

Self-taught technology could push humans aside from some – or all – of the underwriting process

Credit veteran tackles opacity in peer-to-peer lending

PeerIQ CEO Ram Ahluwalia shines a light on the world of peer-to-peer securitisation

Securitisation losses rattle peer-to-peer lenders

Marketplace lending hit by downgrades, legal worries and questions over structure of deals

Basel III transforming securities lending market

New entrants respond to challenges facing primes and lenders

Hedge funds, securitisation and leverage change P2P game

The institutionalisation of P2P lending is creating new risks, critics warn