Organised trading facility (OTF)

Esma supervision proposals ensnare Bloomberg and Tradeweb

Derivatives and bonds venues would become subject to centralised supervision

More trading venues face extra supervision under FCA plan

“Woolly” rules fuel concern that bulletin boards and tech providers could be swept in

EU trading venue definition could crush innovation, fear bank execs

Widening scope of regulated firms could undo progress in fixed income electronification and increase costs

Brexit drives swaps trading to US platforms

Lack of equivalence forces dealers to shift euro and sterling swaps out of European and UK venues

Mifid transparency battle pits dealers against non-banks

Dealers fight to preserve reporting exemptions, but prop traders want US-style regime

AFM seeks to ‘level playing field’ for venues and vendors

Dutch regulator suggests some liquidity aggregators should be classified as OTFs

Deutsche Börse to exit regulatory reporting business

Pricing war and cost pressures force service providers to reconsider regulatory reporting businesses

Trading venues decry disruptors as MTF battle heats up

Unregulated tech vendors accused of operating as de facto venues; a claim dismissed as “entirely outrageous”

AMF’s Ophèle: we need to change EU swaps trading mandate

French regulator urges EU to avoid conflicting rules, adopt principles-based approach after Brexit

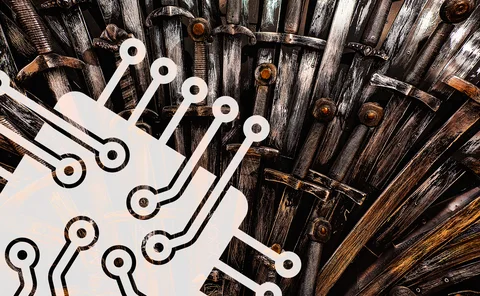

A threat to the Ion throne?

Banks need connections to e-trading venues; they don’t want the other services that come with them

Industry fears EU ‘Google tax’ will hit trading venues, CCPs

Broad wording of digital services tax could place market infrastructure in firing line

Brexit deal talk ‘too late’ for departing brokers

Contingency plans are past point of no return, say venues

Kyte follows broker herd to Europe as Brexit looms

OTF provider lines up contingency plan to transfer London business to Paris entity

Life after London: AMF urges revived capital markets union

French regulator wants supervisory convergence, examines Mifid II impact on market transparency

Isin database users oppose further fee increase

Derivatives Service Bureau may hike fees for top users to cover cost of proposed additional services

Questions remain on scope of Mifid extraterritoriality

Global firms confused about reach of trading obligation and best execution rules

Swaps data: the allure of liquidity

Liquidity in OTC trading concentrates at one venue, or splits across three, writes Amir Khwaja of Clarus FT

CFTC reviewing de minimis threshold for non-US swap firms

Risk of dual registration deterring use of US-EU venue equivalence deal, says official

Hackers’ jackpot: Mifid heightens cyber risk

Platforms and reporting entities develop individual solutions, but no silver bullet

Confusion plagues start of Mifid swaps reporting

Firms reach inconsistent conclusions on scope of transparency requirements

FCA system failure throws Mifid data into doubt

Esma could be left with an incomplete list of instruments subject to reporting requirements