Investment grade

Credit investors struggle to decide what tariffs will mean for defaults

Traders report difficulty evaluating risk, but elevated yields have kept demand strong nonetheless

People: SocGen’s Farah replaces Salorio, Deutsche makes credit hire, and more

Latest job changes across the industry

Legal & General to launch ABS funds amid rising pension demand

After 2022 gilt crisis, trustees and consultants turn to asset-backed securities to bolster portfolio liquidity and returns

Traders eye negative CDS-bond basis

Changed market dynamic can be profitable for those firms able to capture it

Creaky credit sparks ‘high’ dispersion in CLO pricing

Investors are becoming more particular when it comes to tranches and managers

Credit markets falter as dealers slash inventory

Net negative sell-side bond positions exacerbate price gapping and settlement failure

CDS notionals made a comeback in 2021

A 5% rise to highest end-year figure since 2017 driven by swaps on junk debt

Assessing climate risk in bond portfolios

Running climate stress tests on bond portfolios is a nascent exercise for many asset managers. MSCI looks at what to consider when optimising bond portfolios for climate exposures

Insurers’ favourite credit rating becomes more expensive

US institutions face a dilemma: go up a rating and lose yield or go down a rating and increase risk

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

Bond-CDS basis keeps investors interested

Difference between cash bond spreads and derivatives tightens but still offers value, dealers say

Scared of fallen angels? So are the rating agencies

Data shows rating agencies more reluctant to downgrade firms at the investment-grade boundary

Electronic bond trading stalled in volatile markets

Bid/offer spreads on bond platforms spiked in March and the buy side struggled to trade

Investors abandoned junk bond ETFs in March

Forced sale of ‘fallen angels’ could exacerbate outflows at end-April

Quants warn on credit risk in stocks

Conventional models may be missing explosion in novel exposure

Credit data: rising tide lifts fund houses – but can it last?

Strong revenue growth masks structural problems in the funds industry

CDX on junk bonds jumped 65% in H1 2019

Notionals to which CCPs were counterparty increased +85%

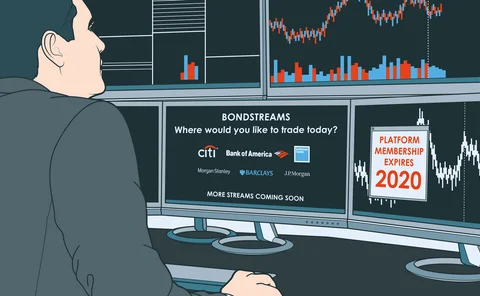

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Credit data: the retail apocalypse continues

Consumers are spending, but brick and mortar retailers continue to struggle

Innovation in execution: Morgan Stanley

Risk Awards 2020: Odd-lot bot handles almost half of bank’s credit trades

Weiss scraps bond strategy amid liquidity qualms

Buy-Side Risk USA: $1.6 billion manager says thinned-out markets make generating alpha hard